Why Dubai CommerCity is a Game Changer

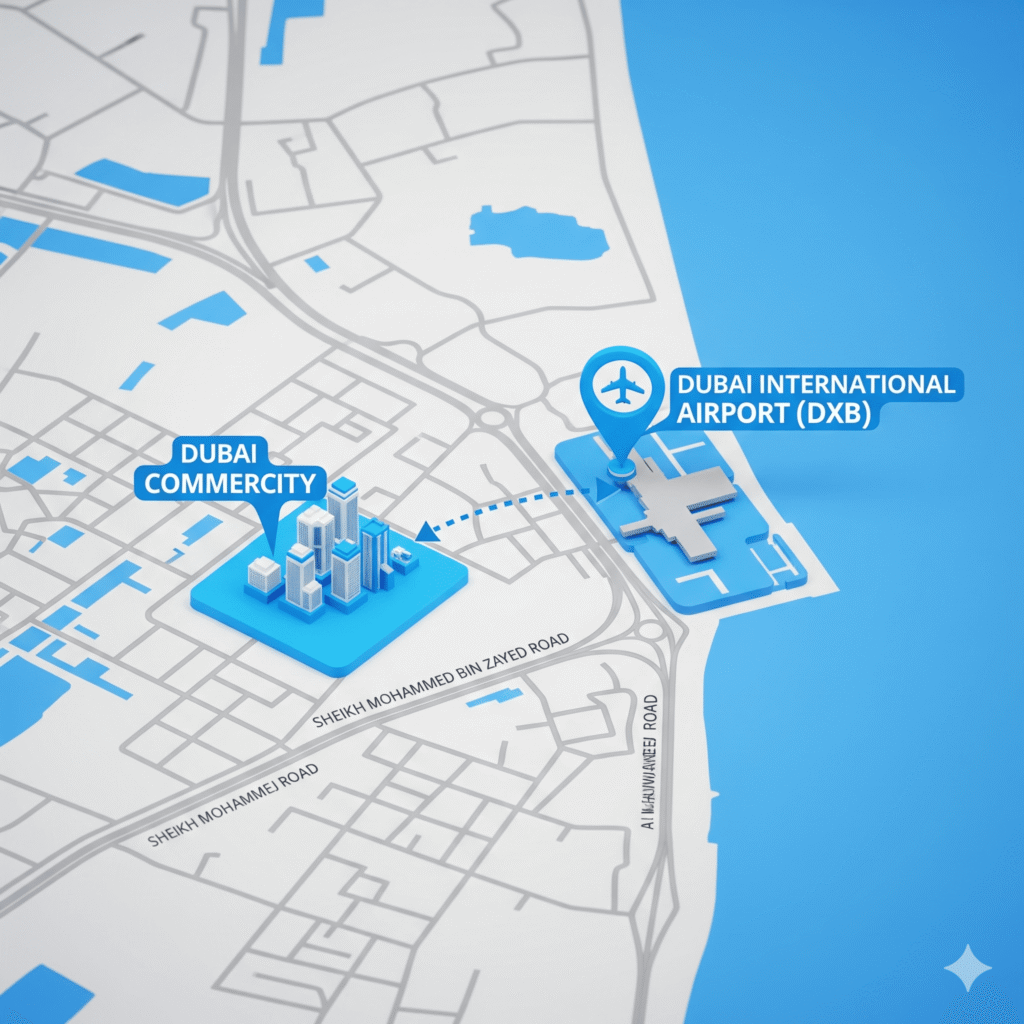

Dubai CommerCity is the Middle East’s first dedicated free zone for e-commerce, strategically designed to help businesses establish, grow, and scale across the UAE, GCC, and global markets. Located in the heart of Dubai, near Dubai International Airport, it offers world-class logistics, advanced infrastructure, and zero customs duties, making it the ideal base for ambitious entrepreneurs.

The UAE government’s pro-business policies, coupled with Dubai CommerCity’s state-of-the-art facilities, make it one of the most attractive destinations for international trade, tech startups, and digital businesses.

However, building a secure and profitable business in Dubai CommerCity goes beyond just setting up your company.

To succeed, you need to:

- Select the right business activity and legal structure.

- Stay on top of VAT registration and compliance.

- Open a corporate bank account to manage operations efficiently.

- Protect your employees with essential insurance policies.

SmartBiz specializes in guiding entrepreneurs and companies through every step — from company formation to banking solutions and compliance support — so you can focus on growing your business.

Table

| Dubai CommerCity is the first e-commerce free zone in the region | Offers specialized infrastructure for trade & online businesses |

| Strategic location near Dubai Airport | Faster logistics & global shipping connections |

| More than company formation is needed for success | VAT, compliance, banking & insurance are essential |

| SmartBiz provides end-to-end setup support | Saves time, ensures compliance & smooth operations |

Understanding Dubai CommerCity

Dubai CommerCity is the Middle East’s first dedicated free zone for e-commerce, strategically located next to Dubai International Airport in the Umm Ramool area. Developed by the Dubai Airport Freezone Authority (DAFZA), it is designed to cater to digital commerce, logistics, and trading companies from around the globe.

This hub is not just another free zone — it is a comprehensive ecosystem that provides businesses with state-of-the-art infrastructure, streamlined regulations, and cutting-edge technology to grow and operate seamlessly in the UAE and across the MENA region.

Key Highlights of Dubai CommerCity

- Strategic Location: Only minutes away from Dubai International Airport, offering unmatched logistics efficiency.

- E-Commerce Focus: Tailored specifically for online retail, logistics, and cross-border trade.

- Modern Infrastructure: Includes advanced warehouses, premium office spaces, and cloud-based business solutions.

- Business-Friendly Environment: 100% foreign ownership, full repatriation of profits, and no corporate tax for a set period.

- Support Services: Licensing, visa processing, customs support, and integrated VAT compliance assistance.

Dubai CommerCity’s Three Clusters

Dubai CommerCity is divided into three purpose-built clusters that cater to different aspects of business operations:

- Business Cluster – Premium offices and co-working spaces for startups, SMEs, and multinational corporations.

- Logistics Cluster – Fully automated warehouses, temperature-controlled storage, and AI-powered inventory systems.

- Social Cluster – Retail outlets, restaurants, cafes, and recreational facilities to support employee well-being.

Why It Matters for New Businesses

For entrepreneurs and companies looking to enter the UAE market, Dubai CommerCity removes traditional barriers by offering:

- Simplified company formation processes.

- Easy access to banking and financial services.

- Built-in VAT registration and compliance support.

- Networking opportunities with other high-growth businesses.

Table – Dubai CommerCity at a Glance

| Feature | Details |

| Location | Next to Dubai International Airport, Umm Ramool |

| Ownership | 100% foreign ownership |

| Primary Focus | E-commerce, logistics, trading |

| Key Benefit | Strategic location for regional and global trade |

| Clusters | Business, Logistics, Social |

| Tax Benefits | Corporate tax exemption (limited years), no import/export duties |

| Support Services | Licensing, visa, VAT, customs, insurance |

Why Choose Dubai CommerCity for Your Business

Dubai CommerCity isn’t just another free zone — it’s a strategic gateway to the MENA e-commerce market, backed by world-class infrastructure, government support, and a location that gives businesses a significant competitive edge.

Whether you are a startup, SME, or a multinational corporation, setting up in Dubai CommerCity offers you the tools and environment to launch, grow, and scale without the common operational barriers faced in other regions.

1. Strategic Location for Global Trade

Positioned just minutes from Dubai International Airport, Dubai CommerCity gives you direct access to global markets. This proximity allows for faster delivery times, cost-effective logistics, and seamless import/export processes.

2. Tailor-Made for E-Commerce & Logistics

Unlike generic free zones, Dubai CommerCity is purpose-built for online retailers, distributors, and logistics providers. From automated warehouses to digital customs clearance, every facility is designed with speed, efficiency, and scalability in mind.

3. Attractive Tax & Ownership Benefits

- 100% foreign ownership – keep complete control of your business.

- No import/export duties within the free zone.

- Corporate tax exemptions for an initial set period.

- Full profit repatriation — take all your earnings back home without restrictions.

4. Simplified Business Setup & Support

Dubai CommerCity’s administration is built for convenience. From company licensing to visa processing and bank account setup, everything is centralized to save you time and effort.

5. Cutting-Edge Infrastructure

Businesses benefit from smart warehouses, high-speed internet, modern offices, and AI-driven operational systems, ensuring efficiency and reduced costs.

6. Networking & Growth Opportunities

Being part of Dubai CommerCity means joining a community of high-growth companies. Networking events, business development programs, and collaboration opportunities help you scale faster.

Table – Benefits of Choosing Dubai CommerCity

| Benefit | Description |

| Prime Location | Directly next to Dubai International Airport for fast global shipping |

| Specialization | Focused on e-commerce, logistics, and trade |

| Ownership Advantages | 100% foreign ownership & profit repatriation |

| Tax Benefits | Corporate tax exemption, no customs duties |

| Business Setup Support | Licensing, visa, VAT, and banking assistance |

| World-Class Infrastructure | Automated warehouses, premium offices, digital systems |

| Networking Potential | Community of regional and global businesses |

Company Formation in Dubai CommerCity

Setting up your company in Dubai CommerCity is more than just renting an office — it’s a strategic business move. This free zone is designed to streamline the setup process, minimize bureaucracy, and provide the perfect foundation for your growth in the UAE and beyond.

Whether you’re a solo entrepreneur, small business owner, or multinational corporation, Dubai CommerCity offers a straightforward registration process with flexible packages to suit different budgets and business needs.

1. Step-by-Step Company Formation Process

Step 1: Choose Your Business Activity

Dubai CommerCity offers a diverse range of activities, including e-commerce, logistics, consulting, marketing, and trading. Your activity determines the type of license you need.

Step 2: Select a Legal Structure

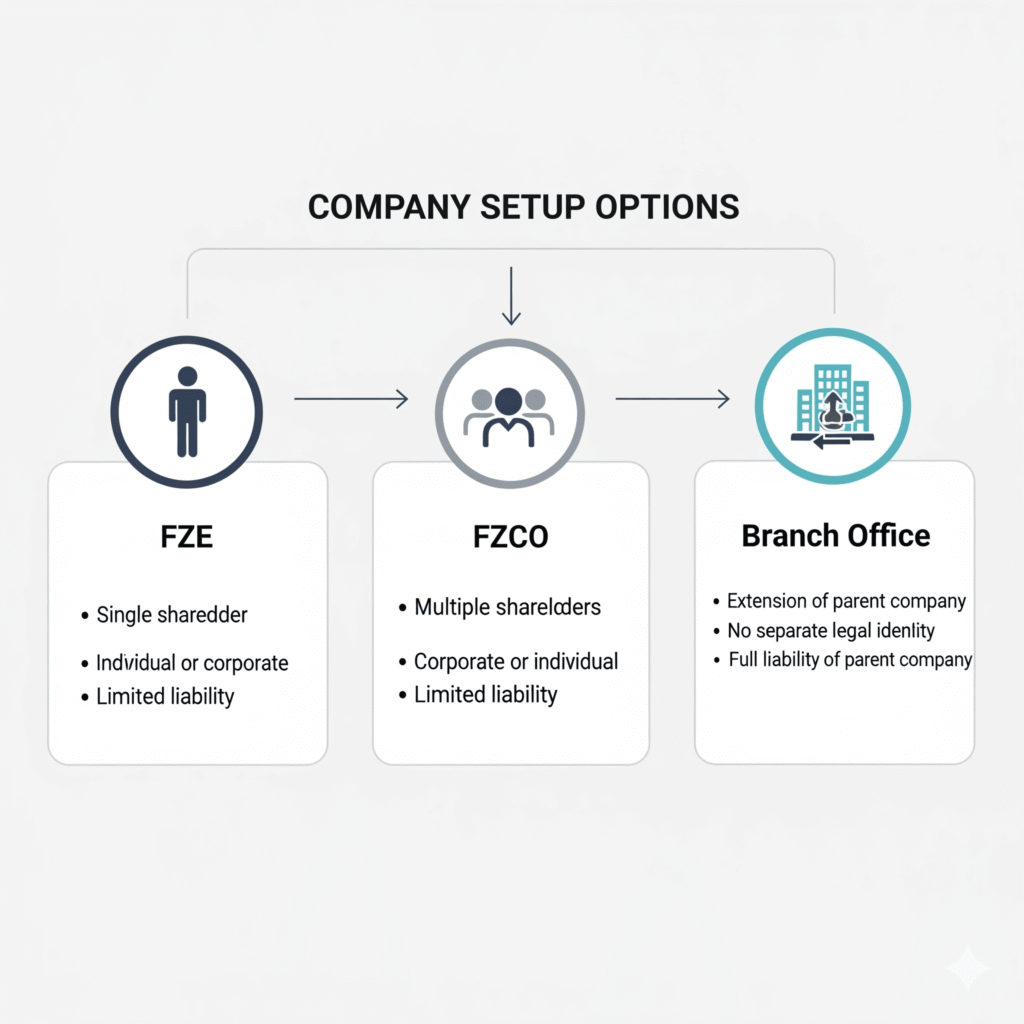

You can register as:

- FZE (Free Zone Establishment) – 1 shareholder.

- FZCO (Free Zone Company) – 2 or more shareholders.

- Branch Office – for existing companies expanding into Dubai CommerCity.

Step 3: Submit Required Documents

Typical requirements include:

- Passport copies of shareholders and directors

- Proof of address

- Business plan

- Application form

Step 4: Get Your Business License

Once approved, you’ll receive your trade license, enabling you to operate legally in Dubai CommerCity.

Step 5: Secure Office/Warehouse Space

Choose from fully serviced offices or modern warehouses, depending on your operational needs.

Step 6: Apply for Visas & Bank Account

You and your employees can get UAE residency visas, and SmartBiz can assist with opening your corporate bank account.

2. Advantages of Starting Here

- Speed: Company setup can be completed in as few as a few days.

- Support: End-to-end assistance with documentation, licensing, and compliance.

- Scalability: Ability to expand operations easily as your business grows.

Table – Company Formation in Dubai CommerCity

| Choose Business Activity | Select from e-commerce, logistics, consultancy, etc. |

| Pick Legal Structure | FZE, FZCO, or Branch Office |

| Submit Documents | Passport copies, proof of address, business plan |

| Get Business License | Trade license approval from Dubai CommerCity authority |

| Secure Workspace | Choose offices or warehouses |

| Visa & Bank Setup | Apply for UAE visas and open a corporate account |

Legal Structure Options for Entrepreneurs in Dubai CommerCity

Choosing the right legal structure is one of the most important decisions when setting up your business in Dubai CommerCity. It affects ownership rights, liability, compliance requirements, and expansion opportunities.

Dubai CommerCity offers three primary types of legal entities, each tailored to meet distinct business needs.

1. Free Zone Establishment (FZE)

- Ownership: Single shareholder (individual or corporate entity).

- Liability: Limited to the invested capital.

- Best For: Solo entrepreneurs or companies wanting full control over decision-making.

- Key Benefit: Fast setup process with minimal documentation.

2. Free Zone Company (FZCO)

- Ownership: Two or more shareholders (individuals, companies, or a mix).

- Liability: Limited to the invested capital.

- Best For: Partnerships or businesses seeking to combine skills and resources.

- Key Benefit: Greater flexibility in capital contributions and profit sharing.

3. Branch of an Existing Company

- Ownership: 100% owned by a parent company (local or international).

- Liability: Falls under the parent company’s legal responsibility.

- Best For: Established businesses seeking a UAE presence without forming a new legal entity.

- Key Benefit: Operates under the same name and business activities as the parent company.

Comparison Table – Legal Structures in Dubai CommerCity

| FZE | 1 | Limited | Solo entrepreneurs | Simple setup, full control |

| FZCO | 2+ | Limited | Partnerships | Flexibility in ownership |

| Branch Office | Parent company | Falls under parent | Expanding businesses | Same brand & activities as parent |

SmartBiz Tip:

If you’re unsure which structure fits your goals, SmartBiz offers free consultations to assess your business model and guide you toward the most strategic choice.

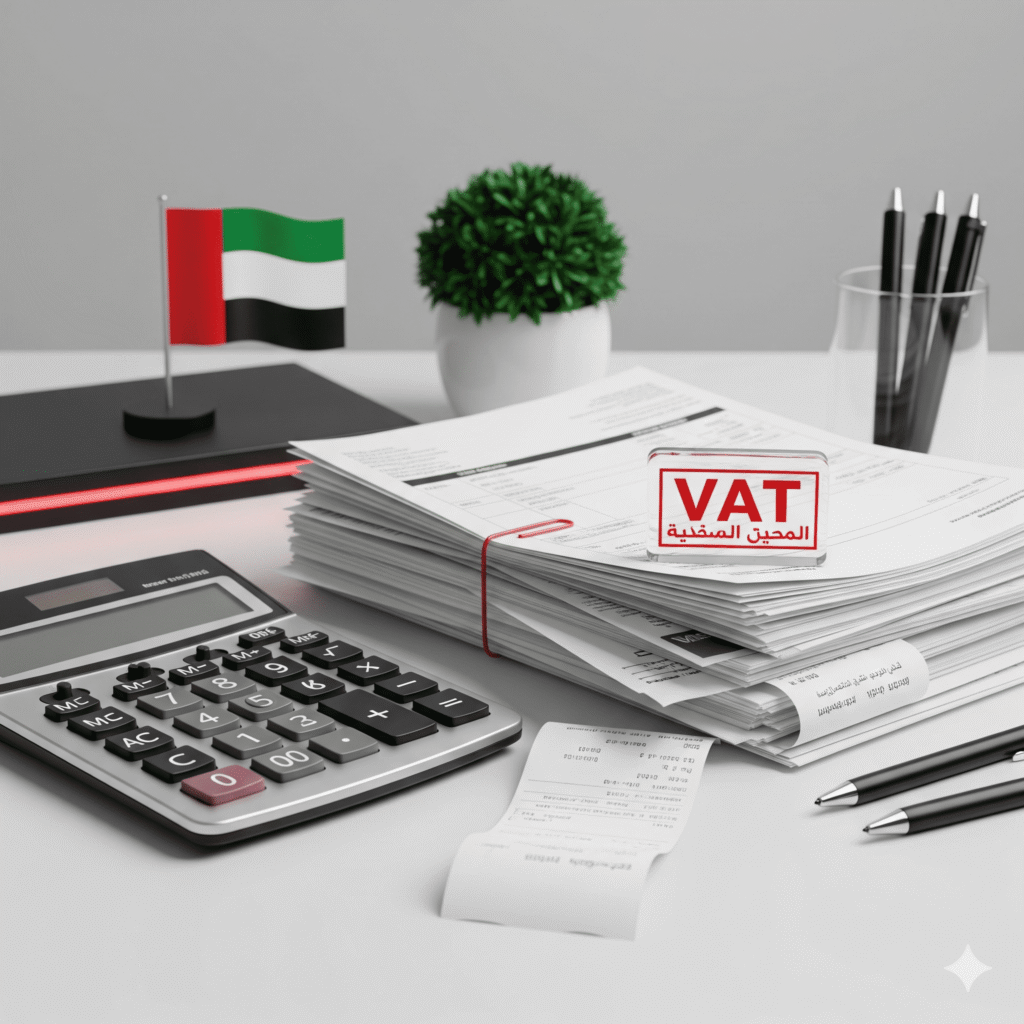

VAT Registration & Compliance in Dubai CommerCity

Since the UAE introduced Value Added Tax (VAT) in 2018, every business operating in Dubai CommerCity must ensure accurate VAT registration, reporting, and payment to remain compliant with the Federal Tax Authority (FTA).

For entrepreneurs, VAT is not just a tax — it’s a legal responsibility that impacts your credibility, financial records, and ability to operate smoothly in the UAE.

Who Needs to Register for VAT in Dubai CommerCity?

VAT registration is mandatory if:

- Your annual taxable supplies exceed AED 375,000 (mandatory registration threshold).

- Voluntary registration is allowed for businesses with taxable supplies or expenses exceeding AED 187,500.

Step-by-Step VAT Registration Process

1. Prepare Documentation

- Trade license from Dubai CommerCity.

- Passport and Emirates ID copies of shareholders and managers.

- Company bank account details.

- Proof of business activities (contracts, invoices, etc.).

2. Create an FTA e-Services Account

Register online via the Federal Tax Authority website.

3. Complete the VAT Application Form

Enter business details, bank information, and expected turnover.

4. Submit & Await Approval

FTA will review and approve your application within a few working days.

5. Receive Your VAT Certificate

This confirms your Tax Registration Number (TRN), which must appear on all invoices.

VAT Compliance Checklist for Dubai CommerCity Businesses

| Issue VAT-Compliant Invoices | Ongoing | Accounts |

| Maintain Accurate Records | Ongoing | Finance |

| File VAT Returns | Quarterly | Accounts |

| Pay VAT Dues to FTA | Quarterly | Finance |

| Update FTA on Changes | As Needed | Management |

Penalties for Non-Compliance

Failing to register or comply with VAT rules can result in substantial fines, starting from AED 10,000, as well as potential business disruptions.

SmartBiz Tip:

At SmartBiz, we help Dubai CommerCity companies register for VAT, manage returns, and stay fully compliant — ensuring you avoid penalties and focus on business growth.

Corporate Bank Account Setup in Dubai CommerCity

Opening a corporate bank account is an essential step for operating a business in Dubai CommerCity. Without it, you cannot receive payments, manage expenses effectively, or build financial credibility in the UAE.

The UAE banking system is highly secure, modern, and globally connected, making it easy for businesses to operate internationally. However, due to strict Know Your Customer (KYC) and anti-money laundering regulations, the process must be handled carefully.

Why Your Business Needs a Corporate Bank Account

- Legal Requirement: Most clients and authorities expect you to transact from a UAE corporate account.

- Professional Credibility: Builds trust with customers, suppliers, and partners.

- Seamless Transactions: Enables easy local and international payments.

- Financial Management: Helps keep personal and business finances separate.

Documents Required for Corporate Bank Account Opening

1. Trade License from Dubai CommerCity.

2. Shareholder and Director Passports & Emirates IDs.

3. Memorandum of Association (MOA) or Articles of Association.

4. Business Plan (for certain banks).

5. Proof of Business Activities (contracts, invoices, lease agreements).

6. Board Resolution authorizing account opening (if applicable).

Step-by-Step Bank Account Opening Process

1. Choose the Right Bank

- Select based on fees, minimum balance requirements, and global accessibility.

2. Submit Application

- Provide all required documents and complete KYC forms.

3. Compliance Review

- Bank conducts background checks to verify your business’s legitimacy.

4. Account Approval

- Once approved, you receive account details and online banking access.

Bank Comparison – Dubai CommerCity Options

| Emirates NBD | AED 50,000 | AED 250 | Yes | Strong UAE presence & global network |

| Mashreq Bank | AED 50,000 | AED 250 | Yes | Fast approval process |

| ADCB | AED 25,000 | AED 150 | Yes | Lower minimum balance |

| RAKBANK | AED 25,000 | AED 100 | Yes | SME-friendly services |

| HSBC Middle East | AED 150,000 | AED 0 | Yes | Best for international trade |

SmartBiz Tip:

At SmartBiz, we work closely with leading UAE banks to ensure fast, hassle-free account opening for Dubai CommerCity businesses, even if you’re a first-time entrepreneur in the region.

ILOE Insurance for Business Owners & Employees in Dubai CommerCity

The Involuntary Loss of Employment (ILOE) Insurance is a mandatory protection scheme in the UAE designed to support employees financially if they lose their jobs due to reasons beyond their control.

For companies in Dubai CommerCity, ensuring compliance with ILOE regulations is not only a legal requirement but also a way to attract and retain top talent.

What is ILOE Insurance?

ILOE is a low-cost insurance policy that provides employees with temporary financial support if they are terminated for reasons other than misconduct or resignation.

It applies to both private sector and federal government employees, including those working in Dubai CommerCity.

Benefits of ILOE Insurance for Businesses

- Compliance: Avoids fines for non-enrollment.

- Employee Security: Provides financial stability in the event of job loss.

- Reputation: Demonstrates your company’s commitment to employee welfare.

- Retention: Employees are more likely to stay with an employer who prioritizes benefits.

Eligibility for ILOE Insurance

| Full-time employees | Must be registered under a UAE work visa | |

| Part-time employees | Pro-rated coverage available | |

| Business owners | Only employees are covered | |

| Domestic workers | Not eligible under ILOE |

ILOE Insurance Coverage & Compensation

- Monthly Benefit: 60% of average basic salary.

- Payout Duration: Up to 3 months per claim.

- Salary Bands:

-

- AED 16 or less/month premium → Salary up to AED 16,000.

- AED 31 or less/month premium → Salary above AED 16,000.

Enrollment Process for ILOE Insurance

1. Register Employees

- Via the official ILOE portal or approved service centers.

2. Pay Premiums

- Can be paid monthly, quarterly, semi-annually, or annually.

3. Receive Policy Confirmation

- Keep a copy for compliance audits.

4. Ongoing Updates

- Ensure all new hires are enrolled within the legal timeframe.

SmartBiz Tip:

SmartBiz ensures that all your employees are properly registered for ILOE Insurance, helping you avoid penalties and maintain a positive reputation as an employer.

Growing Your Business in Dubai CommerCity

Dubai CommerCity offers one of the most fertile grounds for business growth in the UAE. As the region’s first dedicated e-commerce free zone, it blends world-class infrastructure, advanced logistics, and seamless trade facilities. Whether you’re in e-commerce, retail, or logistics, the free zone provides everything you need to scale.

Growth Advantages in Dubai CommerCity

| Strategic Location | Close to Dubai International Airport for global shipping. |

| E-commerce Hub | Built specifically for online businesses. |

| Tax Benefits | 0% corporate and personal income tax. |

| Easy Expansion | Flexible warehousing and office upgrades. |

Tip: Conduct thorough market research before expanding to ensure your products meet demand in the UAE and GCC markets.

Smart Growth Strategies

1. Leverage Logistics Support – Use CommerCity’s integrated warehousing and delivery services.

2. Adopt Digital Marketing – Target GCC customers with Arabic & English campaigns.

3. Diversify Offerings – Expand product categories based on customer insights.

4. Outsource Compliance – Let experts handle VAT and legal obligations.

Table – Growing in Dubai CommerCity

| Location | Global reach in under 48 hours |

| Tax Benefits | More profit reinvestment |

| Support Services | Faster scaling |

| Compliance Management | Risk-free expansion |

FAQs – Dubai CommerCity Business Setup

Q1: What types of businesses can operate in Dubai CommerCity?

A: Primarily e-commerce, logistics, tech startups, and retail businesses targeting local and international markets.

Q2: How long does it take to set up a business in Dubai CommerCity?

A: With SmartBiz, most setups are completed within 5–10 working days, depending on approvals.

Q3: Is VAT registration required for businesses in Dubai CommerCity?

A: Yes, if your annual turnover exceeds AED 375,000, VAT registration is mandatory.

Q4: Can I sell to mainland UAE customers from Dubai CommerCity?

A: Yes, but you must comply with UAE Customs and VAT regulations.

Q5: What are the primary costs associated with setting up in Dubai CommerCity?

A: Licensing fees, office/warehouse rent, VAT registration, and operational costs.

Q6: Does SmartBiz help with visas?

A: Absolutely. We handle investor and employee visa applications.

SmartBiz – Your Trusted Partner in Dubai CommerCity Setup

Setting up a business in Dubai CommerCity can be exciting—but also complex without the right guidance. SmartBiz ensures that your journey from idea to operation is smooth, compliant, and successful.

Why Choose SmartBiz?

| Company Formation | Complete paperwork, licensing, and registration. |

| VAT Compliance | Registration, filing, and audit readiness. |

| Bank Account Setup | Fast-track approvals with leading UAE banks. |

| ILOE Insurance | Secure your team with the latest legal requirements. |

Our Proven Process

1. Consultation – We assess your needs and business model.

2. Legal Setup – We handle licensing, visas, and regulatory approvals.

3. Banking & VAT – We open your corporate bank account and register your VAT.

4. Post-Setup Support – We provide ongoing compliance and scaling advice.

Table – SmartBiz Benefits

| End-to-End Service | From setup to compliance |

| Local Expertise | Knowledge of UAE free zones |

| Speed | Faster licensing & approvals |

| Reliability | 100% compliance record |

Contact us today and let us help you turn your Dubai business idea into reality.

Call Us Today: +971 54 224 3531

Email: info@smartbiz.ae

Go to: https://www.smartbiz.ae/

Work with Dubai’s trusted business setup experts to get your success started.