Dubai has solidified its position as a global business hub, attracting entrepreneurs, investors, and multinational corporations with its strategic location, world-class infrastructure, and business-friendly policies. Among the many opportunities Dubai offers, free zone companies stand out as a top choice for those looking to establish a foothold in the Middle East. A Dubai free zone business setup provides unmatched benefits, including tax exemptions, full ownership, and streamlined processes, making it an attractive option for businesses of all sizes. In this blog, we’ll explore the advantages of free zone companies in Dubai, why they are a game-changer for entrepreneurs, and how you can leverage Dubai free zone advantages to grow your business.

Whether you’re a startup founder, an SME owner, or an investor seeking Dubai free zone business opportunities, understanding the benefits of a Dubai free zone company can help you make informed decisions. From tax benefits of free zone company in Dubai to simplified regulations, this guide covers everything you need to know about starting a free zone company in Dubai and why it’s a smart choice.

A free zone company in Dubai operates within designated economic zones established by the government to foster business growth and attract foreign investment. These zones are regulated by independent authorities, offering a unique legal framework that differs from mainland businesses. The Dubai free zone business setup is designed to provide businesses with a tax-efficient, flexible, and globally connected environment.

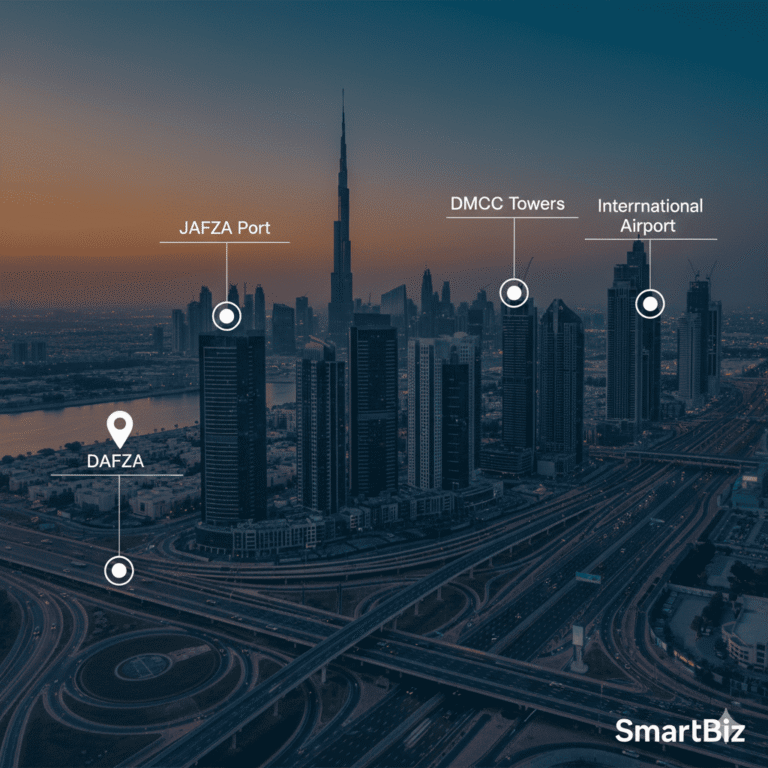

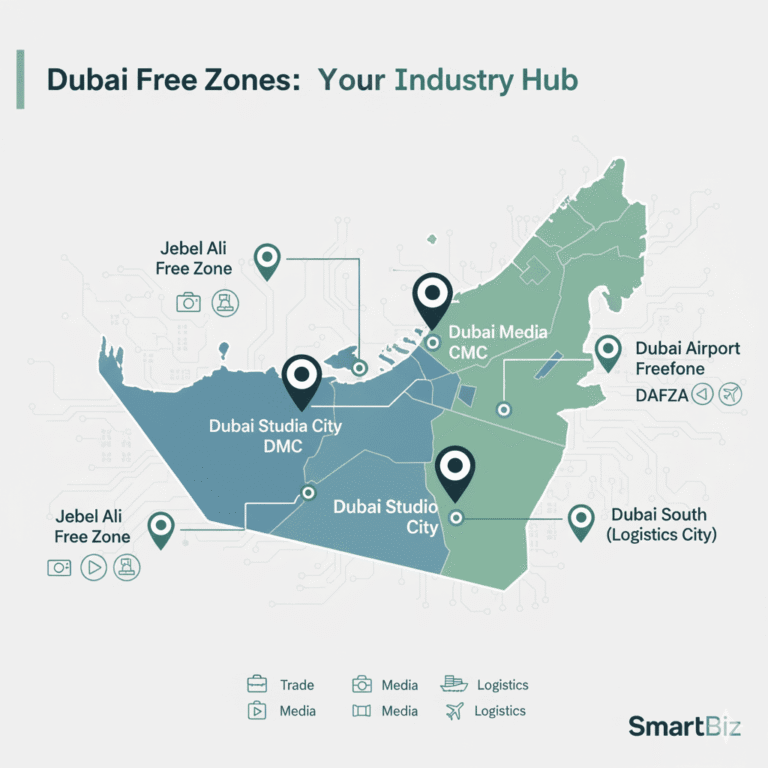

Free zones in Dubai, such as Dubai Multi Commodities Centre (DMCC), Jebel Ali Free Zone (JAFZA), and Dubai Internet City (DIC), cater to specific industries like trading, technology, logistics, and media. Each zone has its own set of rules, but they all share common Dubai free zone advantages, including simplified licensing, customs benefits, and access to world-class infrastructure.

Independent Regulations: Free zones operate under their own legal frameworks, separate from UAE mainland laws.

Industry-Specific Zones: From tech to trading, each free zone supports targeted industries.

Business-Friendly Environment: Streamlined processes make free zone company setup in Dubai quick and efficient.

The advantages of free zone companies in Dubai are numerous, making them a preferred choice for entrepreneurs and investors worldwide. Below, we dive into the key benefits of a Dubai free zone company that can propel your business to new heights.

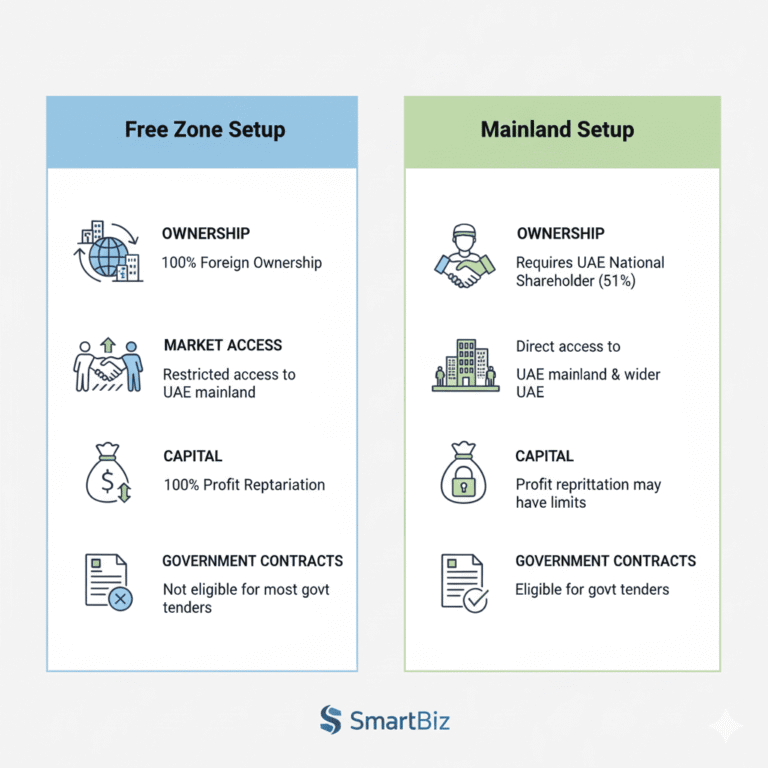

One of the most significant Dubai free zone advantages is the ability to retain 100% foreign ownership. Unlike mainland companies, where local sponsorship was historically required (though recent reforms have relaxed this), free zone companies allow foreign investors to fully own their businesses without the need for a local partner. This gives entrepreneurs complete control over their operations and profits, making starting a free zone company in Dubai highly appealing.

Example: A tech startup from the UK can establish a company in Dubai Internet City and maintain full ownership, ensuring strategic and financial autonomy.

The tax benefits of free zone company in Dubai are a major draw for businesses. Free zone companies enjoy:

0% Corporate Tax: No tax on business profits, allowing companies to reinvest earnings for growth.

0% Personal Income Tax: Employees and business owners benefit from tax-free income.

No Import/Export Duties: Goods imported or exported through free zones are exempt from customs duties, reducing operational costs.

These Dubai free zone license benefits make it easier for businesses to maximize profitability and remain competitive in global markets.

Dubai’s free zones are designed to facilitate international trade, offering easy import and export opportunities. Companies benefit from:

Customs Duty Exemptions: No taxes on goods imported into or exported from free zones.

Streamlined Logistics: Access to world-class ports, airports, and logistics infrastructure, such as Jebel Ali Port, one of the largest in the world.

Global Market Access: Free zones enable businesses to trade seamlessly with international markets without complex regulations.

For example, a trading company in Jebel Ali Free Zone can import raw materials, process them, and export finished products without incurring customs duties, enhancing cost-efficiency.

Obtaining a business license in a Dubai free zone is straightforward, with Dubai free zone license benefits including:

Quick Licensing Process: Licenses are issued in days, not months.

Flexible License Types: Options include trading, industrial, service, and e-commerce licenses, catering to various business models.

Renewal Simplicity: Annual renewals are hassle-free, ensuring business continuity.

These benefits make free zone company setup in Dubai an efficient process for startups and established businesses alike.

Dubai’s strategic location at the crossroads of Europe, Asia, and Africa makes it an ideal hub for global business. The advantages of free zone companies in Dubai include:

Access to Major Markets: Proximity to emerging markets in the Middle East, Africa, and South Asia.

World-Class Infrastructure: State-of-the-art facilities, including offices, warehouses, and logistics hubs.

Global Connectivity: Dubai International Airport and Jebel Ali Port connect businesses to over 2.5 billion consumers within a few hours’ flight.

This strategic positioning enhances Dubai free zone business opportunities for companies looking to expand globally.

The process of free zone company setup in Dubai is designed to be user-friendly, with minimal bureaucracy. Free zone authorities provide dedicated support to guide businesses through licensing, visas, and compliance. This simplicity is a key reason why choose Dubai free zone for entrepreneurs seeking efficiency.

Free zones in Dubai cater to a wide range of industries, creating diverse Dubai free zone business opportunities. Whether you’re launching a startup, scaling an SME, or managing a multinational corporation, free zones offer tailored solutions. Popular sectors include:

Technology: Dubai Internet City and Dubai Silicon Oasis support tech startups and giants like Microsoft and Google.

Trading and Logistics: Jebel Ali Free Zone is a hub for import-export businesses.

E-Commerce: Dubai CommerCity provides infrastructure for online businesses.

Consulting and Services: DMCC supports professional services like consulting, finance, and marketing.

These opportunities make starting a free zone company in Dubai a strategic move for businesses aiming for growth.

While mainland businesses in Dubai have their own merits, why choose Dubai free zone? Here’s a comparison highlighting the benefits of Dubai free zone company:

100% Ownership: Free zones offer full ownership, while mainland businesses may require local sponsorship in certain cases.

Tax Exemptions: Free zones provide tax benefits of free zone company in Dubai, whereas mainland companies may face corporate tax in the future.

Customs Benefits: Free zones offer duty-free import/export, unlike mainland businesses, which may incur customs duties.

Industry Focus: Free zones are tailored to specific industries, providing specialized infrastructure and networking opportunities.

For international investors, Dubai free zone advantages like tax exemptions and global trade access often outweigh mainland options, especially for export-oriented businesses.

Starting a free zone company in Dubai is a straightforward process, with clear steps and requirements. Here’s a step-by-step guide to help you navigate the free zone company setup in Dubai:

Choose the Right Free Zone: Select a free zone aligned with your industry, such as DMCC for trading or Dubai Media City for creative businesses.

Determine Business Activity: Identify the type of business activity (e.g., trading, consulting, manufacturing) to apply for the appropriate license.

Submit Application: Provide necessary documents, including passport copies, business plans, and application forms.

Secure Office Space: Choose from flexi-desks, shared offices, or dedicated facilities based on your needs.

Obtain License: Once approved, you’ll receive your Dubai free zone license, typically within 1-2 weeks.

Open a Bank Account: Set up a corporate bank account in Dubai for seamless transactions.

Apply for Visas: Secure employee and investor visas through the free zone authority.

Passport copies of shareholders and directors.

Business plan or company profile.

Proof of address and No Objection Certificate (NOC) if applicable.

Minimum capital requirements (varies by free zone).

The entire process typically takes 1-4 weeks, depending on the free zone and business complexity. This efficiency is a key Dubai free zone advantage for entrepreneurs eager to launch quickly.

Dubai’s free zones are hubs for innovation and growth, with Dubai free zone business opportunities spanning multiple sectors. Here are some industries thriving in Dubai’s free zones:

Technology: Dubai Internet City and Dubai Silicon Oasis host tech giants and startups, offering infrastructure for AI, software development, and IT services.

Trading and Logistics: Jebel Ali Free Zone supports global trade with its proximity to Jebel Ali Port and advanced logistics facilities.

E-Commerce: Dubai CommerCity provides e-commerce businesses with warehousing, logistics, and digital infrastructure.

Media and Creative: Dubai Media City is home to global media companies, offering studios, networking events, and licensing support.

Consulting and Professional Services: DMCC caters to finance, consulting, and legal firms with tailored office solutions.

The benefits of Dubai free zone company extend to these industries through specialized facilities, networking opportunities, and access to a skilled workforce.

The advantages of free zone companies in Dubai make it an unparalleled destination for entrepreneurs and investors. From 100% foreign ownership and tax benefits of free zone company in Dubai to seamless free zone company setup in Dubai, the benefits are clear. Dubai’s strategic location, world-class infrastructure, and industry-focused free zones create endless Dubai free zone business opportunities for startups, SMEs, and multinational corporations.

By choosing a Dubai free zone business setup, you gain access to Dubai free zone license benefits, simplified regulations, and a gateway to global markets. Whether you’re in tech, trading, or consulting, why choose Dubai free zone? Because it offers the perfect blend of flexibility, cost-efficiency, and growth potential.

Ready to take your business global? Explore the benefits of a Dubai free zone company today and contact a free zone authority or business setup consultant to start your journey. Don’t miss out on the Dubai free zone advantages that can transform your entrepreneurial vision into reality!

The advantages of free zone companies in Dubai include 100% foreign ownership, tax benefits of free zone company in Dubai (0% corporate and personal tax), duty-free import/export, and access to world-class infrastructure. Additionally, the Dubai free zone business setup is streamlined, making it quick and efficient for entrepreneurs to start their businesses.

The free zone company setup in Dubai involves selecting a free zone aligned with your industry, choosing a business activity, submitting documents (e.g., passport copies, business plan), securing office space, and obtaining a Dubai free zone license. The process typically takes 1-4 weeks, offering Dubai free zone advantages like minimal bureaucracy and fast approvals.

Choosing a Dubai free zone offers benefits of Dubai free zone company such as 100% foreign ownership, tax benefits of free zone company in Dubai, and customs duty exemptions. Unlike mainland companies, free zones cater to specific industries with tailored infrastructure and provide easier access to global markets, making them ideal for export-oriented businesses.

The Dubai free zone license benefits include quick issuance (often within days), flexible license types (e.g., trading, service, e-commerce), and hassle-free renewals. These licenses enable businesses to operate in a tax-free environment with access to Dubai free zone business opportunities, enhancing operational efficiency and profitability.

Dubai free zone business opportunities are vast, with thriving industries like technology (Dubai Internet City), trading and logistics (Jebel Ali Free Zone), e-commerce (Dubai CommerCity), and media (Dubai Media City). The benefits of Dubai free zone company include specialized facilities, networking, and global connectivity, making them ideal for startups, SMEs, and large corporations.