Dubai continues cementing its position as a global business hub in 2026, attracting thousands of international entrepreneurs seeking strategic market access, world-class infrastructure, and business-friendly regulations. Among the emirate’s numerous free zones, one consistently ranks as the most prestigious and sought-after: DMCC. But what is DMCC in Dubai UAE 2026, and why do so many businesses choose this particular free zone?

The DMCC Dubai UAE 2026 represents far more than just another company registration option—it’s a globally recognized ecosystem offering credibility, connectivity, and comprehensive business support. Whether you’re a commodity trader, technology startup, professional services firm, or crypto business, understanding the DMCC free zone UAE 2026 and its unique advantages helps you make informed decisions about your UAE business establishment.

This comprehensive guide explains everything about DMCC, from its fundamental definition and authority structure to company formation processes, license types, benefits, and strategic comparisons with other UAE business setup options.

What Is DMCC in Dubai UAE 2026?

DMCC stands for Dubai Multi Commodities Centre, a government-owned free zone economic authority established in 2002 with a specific mission: positioning Dubai as the global hub for commodity trade and enterprise. By 2026, DMCC has evolved far beyond its original commodities focus to become one of the world’s most diverse and dynamic business districts.

The simple answer to “what is DMCC UAE 2026” is that it’s a special economic zone offering businesses 100% foreign ownership, tax advantages, simplified company formation, and access to world-class infrastructure—all while operating under its own regulatory framework separate from Dubai mainland.

Is DMCC a free zone UAE 2026? Yes, absolutely. DMCC is one of UAE’s premier free zones, meaning companies registered there operate under specific free zone regulations rather than mainland commercial laws. This status provides distinct advantages including complete foreign ownership without requiring UAE national partners, tax exemptions on corporate income and personal earnings, simplified business setup procedures, and the ability to repatriate 100% of capital and profits.

Located in the prestigious Jumeirah Lakes Towers (JLT) district, DMCC Dubai UAE 2026 encompasses over 30 commercial and residential towers, creating an integrated live-work-play environment. This strategic location provides excellent connectivity to Dubai Marina, Sheikh Zayed Road, Dubai Internet City, and Dubai Media City, positioning DMCC companies at the heart of Dubai’s commercial corridor.

DMCC’s transformation from commodity-focused zone to diversified business hub reflects Dubai’s economic evolution. While maintaining strength in commodity trading (gold, diamonds, precious metals, tea, coffee), DMCC now hosts technology companies, fintech firms, cryptocurrency businesses, professional services, consulting firms, and innovative startups across virtually every industry sector.

DMCC Meaning, Authority & Government Role

Understanding the DMCC authority Dubai structure clarifies why this free zone carries exceptional credibility and regulatory strength.

Government Ownership and Status: DMCC operates as a government entity owned by the Government of Dubai. This government backing provides stability, regulatory clarity, and global confidence that appeals to international businesses and financial institutions. Unlike privately operated free zones, DMCC’s government ownership means policy consistency, long-term strategic planning, and alignment with Dubai’s broader economic vision.

Regulatory Authority: DMCC functions as both a free zone authority and business regulator. It issues trade licenses, enforces compliance standards, maintains business registries, and ensures companies operating within its jurisdiction meet international best practices. This dual role as facilitator and regulator creates a balanced environment supporting business growth while maintaining high operational standards.

International Recognition: The DMCC authority Dubai has achieved remarkable international standing, consistently ranking as the world’s number one free zone by the Financial Times’ fDi Magazine for multiple consecutive years. This recognition stems from DMCC’s comprehensive ecosystem, business-friendly policies, infrastructure excellence, and proven track record supporting company success.

Strategic Mandate: Beyond company registration, DMCC actively develops Dubai’s position in global trade networks. It organizes international conferences, facilitates trade missions, provides market intelligence, and creates platforms connecting businesses across industries and geographies. This proactive approach means DMCC membership provides networking and business development opportunities beyond basic licensing.

DMCC Free Zone Explained (2026 Update)

The DMCC free zone UAE 2026 operates under specific frameworks differentiating it from both mainland Dubai and other free zones.

How DMCC Free Zone Works: Companies registered in DMCC receive trade licenses permitting specific business activities within defined regulatory parameters. These licenses allow international trading, service provision to global clients, and certain UAE market access through distributors or agents. DMCC companies cannot directly access UAE mainland consumers for retail activities without separate arrangements, but they can freely conduct international business, import and export goods, and provide B2B services.

Location Advantage: The DMCC location JLT Dubai provides exceptional convenience and prestige. Jumeirah Lakes Towers offers Grade A office spaces ranging from flexi-desks to entire floor plates, meeting diverse business needs and budgets. The area features excellent transportation links including metro access, proximity to major highways, and convenient connections to Dubai International Airport and Al Maktoum International Airport.

The surrounding district includes residential towers, hotels, restaurants, retail outlets, and recreational facilities, creating comprehensive lifestyle amenities. This integrated environment attracts talented professionals who can live, work, and socialize within walkable distances, enhancing employee satisfaction and recruitment success.

Regulatory Framework: DMCC operates under UAE federal laws while maintaining its own specific regulations governing business activities, licensing requirements, and operational standards. This framework provides clarity while offering flexibility that mainland regulations sometimes lack. Companies benefit from streamlined processes, clear guidelines, and responsive regulatory support.

Infrastructure Excellence: DMCC continuously invests in world-class infrastructure including smart office buildings with advanced technology integration, high-speed internet connectivity ensuring seamless digital operations, modern logistics and warehousing facilities for trading companies, and comprehensive security systems protecting businesses and personnel.

DMCC Company Formation UAE – Step-by-Step

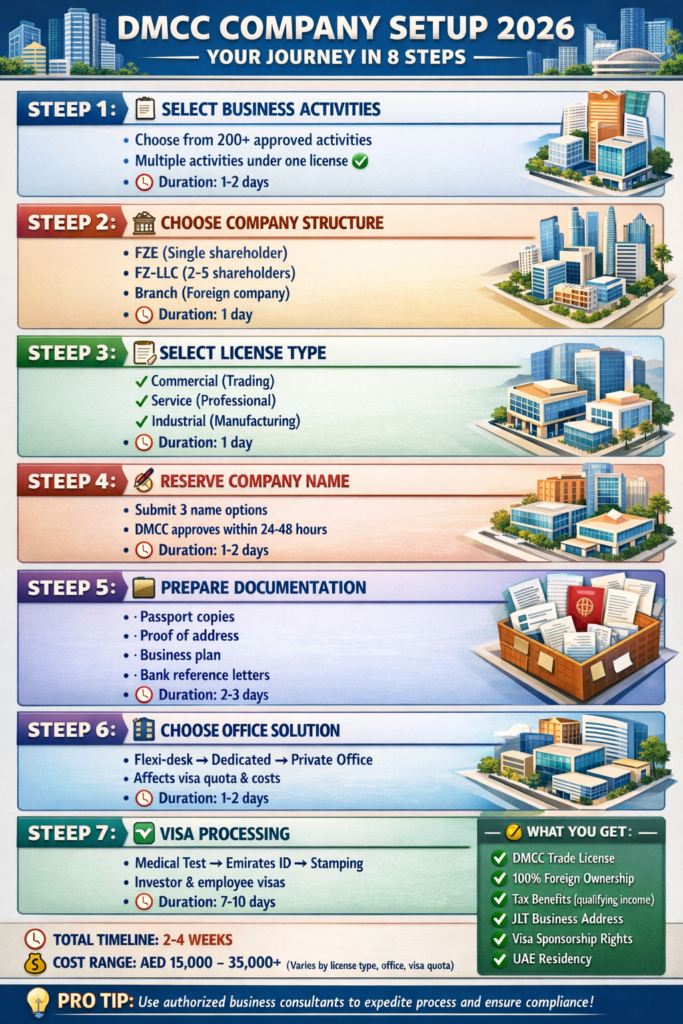

Understanding the DMCC company formation UAE process helps entrepreneurs plan timelines and requirements effectively.

Step 1: Business Activity Selection – Identify your intended business activities from DMCC’s extensive approved list. You can include multiple complementary activities under one license, providing operational flexibility. Popular activities include general trading, consultancy services, technology development, financial services, marketing and advertising, and commodity trading specializations.

Step 2: Company Structure Decision – Choose your legal entity type. Options include Free Zone Establishment (FZE) for single-shareholder companies, Free Zone Company (FZ-LLC) for multiple shareholders up to five, and branch of foreign company for international businesses establishing UAE presence. Each structure has specific implications for ownership, management, and operational flexibility.

Step 3: License Type Selection – Determine whether you need a commercial license for trading activities, service license for professional and consultancy services, or industrial license for manufacturing and production activities. DMCC also offers specialized licenses for crypto businesses, dual licenses combining trading and services, and general trading licenses covering broad commodity categories.

Step 4: Name Reservation – Submit proposed company names for approval. Names must comply with UAE naming conventions, avoid restricted terms, reflect your business activities, and not infringe existing trademarks. DMCC typically processes name reservations quickly, confirming availability within 24-48 hours.

Step 5: Documentation Preparation – Gather required documents including shareholder passport copies, proof of address documentation, business plan outlining operations and projections, bank reference letters confirming financial standing, and educational certificates for certain regulated activities. Professional license holders may need degree attestations.

Step 6: Office Space Selection – Choose appropriate office solutions from flexi-desk packages for minimal physical presence requirements, dedicated desks in shared spaces, private offices in DMCC towers, or large commercial spaces for growing companies. Your choice affects licensing costs and visa quotas.

Step 7: License Issuance – Submit applications through DMCC’s online portal or authorized business setup consultants. Pay required fees covering license issuance, registration, and initial services. DMCC processes applications efficiently, typically issuing licenses within days of complete submission.

Step 8: Visa Application – Apply for investor and employee visas based on your license’s visa quota. The process includes medical fitness examinations, Emirates ID registration, visa stamping, and final documentation. DMCC business setup Dubai timelines from application to full operational status typically span 2-4 weeks for straightforward cases.

DMCC License Types & Business Activities

The variety of DMCC license UAE options accommodates diverse business models and industries.

Commercial Trading Licenses: These licenses authorize buying, selling, importing, and exporting goods internationally. Specific categories include general trading covering multiple commodity types, specialized commodity trading for focused product lines like gold, diamonds, tea, coffee, or electronics, and e-commerce trading licenses for online retail and distribution businesses.

Service Licenses: Professional service providers obtain licenses covering consulting, advisory, marketing, technology services, financial advisory, legal consultancy within free zone parameters, and creative services including design and content creation. Service licenses typically cost less than trading licenses and suit knowledge-based businesses.

Industrial Licenses: Manufacturing and production companies require industrial licenses authorizing production activities, quality control, packaging and labeling, and distribution of manufactured goods. These licenses often have specific facility requirements ensuring proper production environments.

Crypto and Digital Asset Licenses: Recognizing blockchain industry growth, DMCC offers specialized licenses for cryptocurrency businesses, blockchain technology companies, digital asset trading platforms, and crypto advisory services. This forward-thinking approach positions DMCC as a global crypto hub attracting innovative companies.

Popular Industries Among DMCC Companies in UAE: The DMCC companies in UAE span virtually every sector, with particular strength in precious metals and gemstone trading, technology and software development, financial services and fintech, consulting and professional services, media and marketing agencies, and logistics and supply chain management. This diversity creates networking opportunities and collaborative ecosystems supporting business growth.

Benefits of DMCC Free Zone for Businesses

The DMCC benefits for businesses extend far beyond basic free zone advantages, creating compelling value propositions for international entrepreneurs.

100% Foreign Ownership: Perhaps the most significant advantage, complete foreign ownership means entrepreneurs maintain full control over their businesses without requiring UAE national partners or sponsors. You make all strategic decisions, retain all profits, and build equity value entirely for your benefit.

Tax Advantages in 2026: While UAE implemented federal corporate tax, free zone businesses meeting qualifying conditions can benefit from 0% tax on qualifying income. DMCC free zone UAE 2026 companies that comply with substance requirements, don’t conduct business with UAE mainland, and maintain proper documentation may access these tax benefits. Additionally, there’s no personal income tax on salaries and earnings, and no withholding taxes on cross-border payments.

Global Credibility and Reputation: A DMCC company UAE 2026 registration carries exceptional prestige. International banks, investors, and business partners recognize DMCC’s standards and regulatory framework, facilitating banking relationships, investment attraction, partnership development, and global business expansion. This credibility advantage often justifies DMCC’s premium positioning versus lower-cost alternatives.

Comprehensive Business Ecosystem: Beyond licensing, DMCC provides extensive support services including business networking events and conferences, market intelligence and research resources, trade mission facilitation, professional development programs, and access to DMCC’s global business network spanning 180+ countries.

World-Class Infrastructure: Members access premium facilities including modern office spaces with flexible configurations, advanced telecommunications infrastructure, proximity to logistics hubs and airports, integrated commercial and residential environments, and comprehensive security and facility management.

Simplified Operations: DMCC streamlines business processes through efficient online portals for all transactions, clear regulatory guidelines, responsive customer support, and transparent fee structures. This operational ease allows entrepreneurs to focus on business development rather than bureaucratic complexity.

Capital and Profit Repatriation: No restrictions apply to repatriating capital, profits, or dividends. You can freely transfer funds internationally without exchange controls or conversion requirements, maintaining financial flexibility essential for international business operations.

DMCC vs Other Free Zones in UAE (2026 Comparison)

Understanding DMCC vs other free zones helps entrepreneurs select optimal jurisdictions for their specific needs.

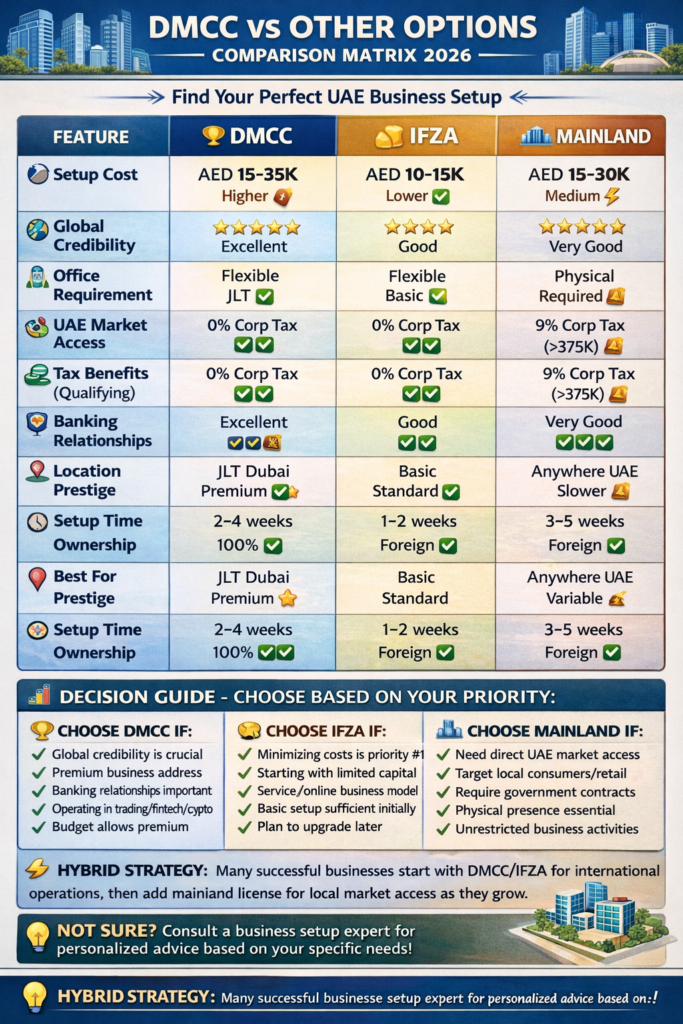

DMCC vs IFZA: IFZA (International Free Zone Authority) offers significantly lower setup costs, making it attractive for bootstrapped startups and cost-conscious entrepreneurs. However, DMCC provides superior global credibility, more prestigious business address, stronger banking relationship facilitation, and more comprehensive business support ecosystem. Choose DMCC for credibility-focused businesses willing to invest in premium positioning, or IFZA for cost-efficiency when budget constraints dominate.

DMCC vs DAFZA: Dubai Aviation City’s DAFZA specializes in aviation, logistics, and aerospace industries, offering proximity to Al Maktoum International Airport. DMCC provides broader industry diversity, stronger commodities and trading focus, more central Dubai location, and greater general business recognition. Aviation-related businesses benefit from DAFZA specialization, while other industries typically prefer DMCC’s versatile ecosystem.

DMCC vs Meydan Free Zone: Meydan offers competitive pricing positioned between IFZA and DMCC, with good infrastructure and growing reputation. DMCC maintains advantages in established global recognition, more comprehensive business facilities, larger professional community, and proven long-term stability. Meydan suits businesses seeking middle-ground options balancing cost and credibility.

DMCC vs Dubai South: Dubai South provides exceptional value for logistics, e-commerce, and manufacturing businesses needing warehouse facilities and airport proximity. DMCC better serves trading, professional services, technology companies, and businesses prioritizing central Dubai location and international prestige over logistics convenience.

The choice among free zones ultimately depends on your industry focus, budget parameters, credibility requirements, location preferences, and long-term business objectives. DMCC typically represents the premium choice for established entrepreneurs and businesses where reputation matters significantly.

DMCC vs Mainland Dubai – Which Is Better?

The mainland vs free zone Dubai decision represents one of the most important strategic choices for UAE business setup.

Ownership and Control: Both DMCC and mainland now allow 100% foreign ownership for most business activities following recent regulatory reforms. This eliminates the historical advantage free zones held regarding ownership, though certain mainland activities still require UAE national partnerships.

Market Access: Mainland companies enjoy unrestricted access to UAE domestic markets, allowing direct sales to local consumers, government contract eligibility, and retail operations throughout the emirates. DMCC companies face restrictions on direct mainland market access, requiring distributors or agents for UAE consumer sales, though international trading remains unrestricted.

Setup and Operating Costs: DMCC typically involves higher initial license costs compared to mainland, though transparent fee structures and included services often provide better value. Mainland setups historically required higher costs, though competitive pressures have reduced some differences. Ongoing renewal and operational costs vary based on specific requirements and chosen service providers.

Office Requirements: DMCC offers flexible office solutions from flexi-desks to full commercial spaces, accommodating various budgets and needs. Mainland companies traditionally required physical office leases in approved business centers, though virtual office options have expanded in recent years.

Tax Considerations: DMCC companies meeting qualifying conditions may access 0% corporate tax on qualifying income, while mainland companies generally face 9% corporate tax on profits exceeding AED 375,000. This tax differential can significantly impact financial planning, though substance and compliance requirements apply to free zone benefits.

Banking Relationships: Both DMCC and mainland companies can establish corporate bank accounts, though DMCC’s strong reputation often facilitates smoother banking onboarding. Mainland licenses sometimes provide slight advantages with certain local banks, though differences have narrowed considerably.

Visa Allocation: Both structures provide visa sponsorship capabilities based on office space and license type. Visa quotas and processes are generally comparable, though specific allocations vary by jurisdiction and package.

Strategic Recommendation: Choose DMCC if you operate internationally, prioritize global credibility, don’t need direct mainland market access, want tax optimization opportunities, and seek comprehensive business ecosystem support. Choose mainland if you target UAE domestic consumers, require government contract eligibility, need unrestricted local market access, and operate businesses specifically requiring mainland presence.

Who Should Choose DMCC in 2026?

The DMCC company UAE 2026 setup particularly suits specific business profiles and entrepreneurial situations.

International Traders: Businesses engaged in commodity trading, import-export operations, and global supply chain management find DMCC’s trading infrastructure, global connections, and regulatory framework ideally suited to their operations. The zone’s heritage in commodities trading provides specialized support, networking, and market intelligence.

Technology and Fintech Companies: DMCC has emerged as a technology hub attracting software developers, SaaS businesses, fintech startups, blockchain companies, and digital service providers. The ecosystem includes technology-focused networking, access to venture capital and investors, and regulatory frameworks supporting innovation.

Cryptocurrency and Blockchain Businesses: DMCC’s progressive approach to crypto regulation makes it one of the world’s premier jurisdictions for blockchain businesses. Companies benefit from clear regulatory guidance, specialized licensing options, banking relationship facilitation, and connection to global crypto communities.

Professional Services Firms: Consultants, advisors, marketing agencies, and professional service providers appreciate DMCC’s credibility, professional environment, and access to corporate clients. The prestigious address enhances client confidence and supports premium service positioning.

Established Entrepreneurs: Business owners with successful track records seeking UAE expansion often choose DMCC for its reputation and comprehensive support. The premium positioning aligns with established business brands and facilitates international partnership development.

Businesses Prioritizing Credibility: When business reputation significantly impacts success—such as financial services, high-value trading, or premium B2B services—DMCC’s globally recognized standing justifies premium costs through enhanced credibility, easier banking access, and stronger partner confidence.

Companies Requiring Substance: Businesses needing demonstrable economic substance for tax planning, regulatory compliance, or international recognition benefit from DMCC’s robust infrastructure, professional ecosystem, and clear regulatory framework supporting substance requirements.

FAQs – DMCC in Dubai UAE 2026

What is DMCC in Dubai?

DMCC is the Dubai Multi Commodities Centre, a government-owned free zone established to position Dubai as a global hub for commodity trade and enterprise. It offers businesses 100% foreign ownership, tax benefits, world-class infrastructure, and access to international markets while operating under its own regulatory framework separate from Dubai mainland.

Is DMCC a government entity?

Yes, DMCC is a government-owned entity operating under the Government of Dubai. This government backing provides regulatory stability, international credibility, and alignment with Dubai’s broader economic strategy, differentiating it from privately operated free zones and enhancing trust among international businesses and financial institutions.

Why choose DMCC free zone?

DMCC offers exceptional global credibility, comprehensive business ecosystem, 100% foreign ownership, potential tax advantages, world-class infrastructure in prestigious JLT location, access to extensive networking opportunities, and proven regulatory framework. It’s ideal for businesses prioritizing reputation, international operations, and professional environment over cost minimization.

Who can register a company in DMCC?

Any international entrepreneur or business can register in DMCC regardless of nationality. There are no citizenship restrictions for company ownership. Both individuals and corporate entities can establish DMCC companies, with options for single-shareholder setups (FZE) or multi-shareholder structures (FZ-LLC) accommodating various ownership preferences.

How does DMCC free zone work?

DMCC operates as a special economic zone with its own regulations separate from mainland Dubai. Companies receive trade licenses permitting specific business activities, enjoy 100% foreign ownership, benefit from tax advantages when meeting qualifying conditions, access international markets freely, and operate under streamlined regulatory framework while maintaining UAE legal compliance.

What does DMCC stand for?

DMCC stands for Dubai Multi Commodities Centre. While originally focused on commodity trading, DMCC has evolved into a diversified business hub accommodating technology, professional services, fintech, crypto, and virtually all commercial activities while maintaining its strength in commodities including gold, diamonds, and precious metals trading.

Conclusion

Understanding what is DMCC UAE 2026 reveals why this free zone consistently attracts ambitious entrepreneurs and established businesses seeking UAE presence. The DMCC Dubai UAE 2026 represents more than simple company registration—it’s membership in a globally recognized business community offering credibility, connectivity, and comprehensive support.

The DMCC free zone UAE 2026 provides compelling advantages including complete foreign ownership, strategic tax benefits, world-class infrastructure, and prestigious Jumeirah Lakes Towers location. For businesses where reputation matters, international credibility drives success, and professional ecosystem provides value, DMCC’s premium positioning justifies its costs through tangible business advantages.

Whether you’re a commodity trader leveraging DMCC’s heritage expertise, a technology startup accessing innovative ecosystems, a professional services firm building credible positioning, or an established business expanding internationally, the DMCC company UAE 2026 option deserves serious consideration in your UAE business strategy.

The decision between DMCC, other free zones, or mainland depends on your specific business model, budget parameters, market access requirements, and strategic priorities. However, for businesses prioritizing global credibility, comprehensive support, and proven regulatory frameworks, DMCC remains the gold standard among UAE business jurisdictions.

If you’re ready to explore DMCC company formation UAE or need guidance determining whether DMCC aligns with your business objectives, consulting experienced company formation specialists ensures you make informed decisions backed by expert insights. Your UAE business journey begins with choosing the right foundation—make that choice strategically, and DMCC might be exactly what your business needs to thrive in 2026 and beyond.