The Meydan Free Zone Dubai UAE 2026 continues to establish itself as one of the most attractive business destinations for entrepreneurs, startups, and international companies looking to expand into the Middle East market. With its strategic location, business-friendly regulations, and comprehensive support services, the Meydan Free Dubai UAE 2026 offers a compelling proposition for those seeking to establish a presence in one of the world’s most dynamic economic hubs.

As we move through 2026, the landscape of Dubai free zones 2026 has become increasingly competitive, yet Meydan Free Zone maintains its distinct advantages through innovative policies, streamlined processes, and a commitment to supporting business growth. Whether you’re a tech startup, trading company, service provider, or industrial enterprise, understanding the intricacies of Meydan business setup Dubai will be crucial to your success.

This comprehensive guide explores everything you need to know about the Meydan Free Zone Authority Dubai UAE 2026, including company formation processes, license types, fee structures, regulatory requirements, and the practical steps to establish your business in this prestigious free zone.

What is Meydan Free Zone Authority?

The Meydan Free Zone Authority Dubai UAE 2026 is a government-regulated entity that oversees business operations within the Meydan Free Zone, located in the heart of Dubai near the iconic Meydan Racecourse and Meydan Hotel. Established to promote economic diversification and attract foreign investment, the authority provides a complete ecosystem for businesses ranging from small startups to large multinational corporations.

The Meydan Free Zone Authority Services 2026 encompass a wide spectrum of business support functions, including company registration, licensing, visa processing, office space allocation, and ongoing compliance management. The authority operates with a clear mandate to simplify business setup procedures while maintaining international standards of corporate governance and transparency.

What distinguishes the Meydan Free Zone Authority Dubai UAE 2026 from other free zones is its focus on providing flexible, customized solutions that cater to diverse business needs. The authority recognizes that modern businesses require agility, and it has structured its services accordingly, offering both physical office spaces and virtual office options, multiple license categories, and scalable visa packages.

The jurisdiction allows various business types including trading companies, service providers, technology firms, consulting businesses, e-commerce operations, media companies, and light industrial enterprises. This versatility makes Meydan corporate setup UAE attractive to a broad spectrum of industries and business models.

Company Formation in Meydan Free Zone 2026

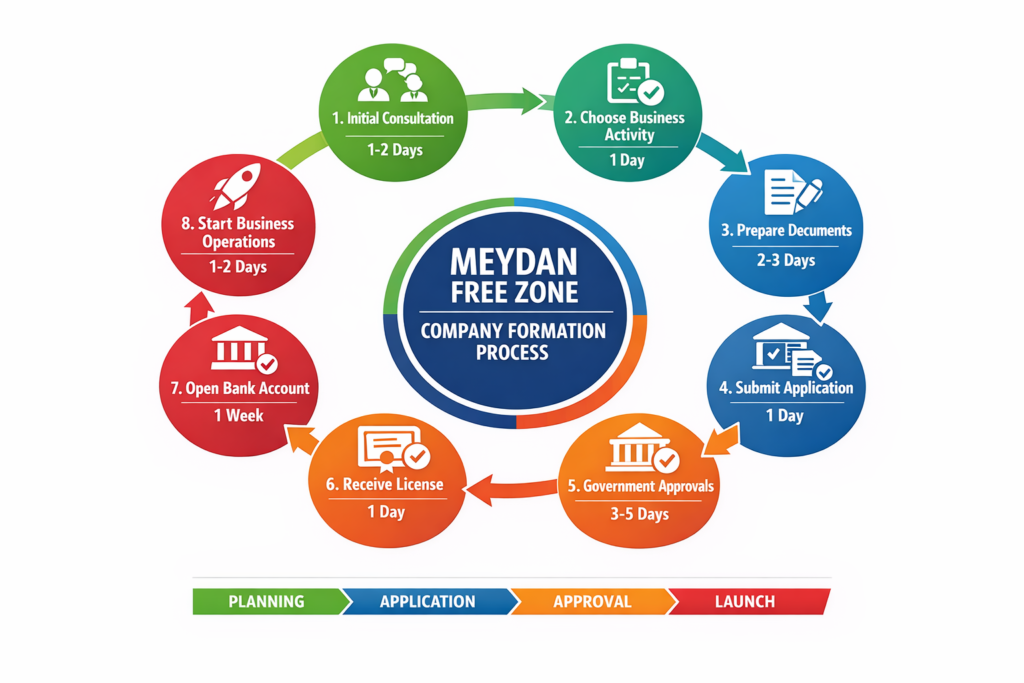

Understanding the Meydan Free Zone Company Formation Dubai UAE 2026 process is essential for anyone considering establishing operations in this jurisdiction. The formation process has been significantly streamlined in recent years, with digital platforms and efficient procedures reducing setup time considerably.

Types of Companies Allowed:

The Meydan Freezone Company Formation Dubai UAE 2026 framework permits several company structures:

- Free Zone Establishment (FZE): A limited liability company with a single shareholder, ideal for sole entrepreneurs or wholly-owned subsidiaries of foreign companies

- Free Zone Company (FZCO): A limited liability company with two to five shareholders, suitable for partnerships and joint ventures

- Branch Office: An extension of an existing company registered elsewhere, allowing the parent company to conduct business in the UAE

Each structure has distinct characteristics regarding ownership, management, and operational flexibility. Most entrepreneurs opt for FZE or FZCO structures as they provide complete ownership and operational independence.

Steps for Company Registration:

The Meydan Company Formation in Meydan Free Zone 2026 follows a systematic approach:

- Business Activity Selection: Determine your primary and secondary business activities from the approved list maintained by the authority. Your activities will dictate the license type you require.

- Company Name Reservation: Choose and reserve a unique company name that complies with UAE naming conventions. The name must reflect your business activities and cannot include restricted terms without proper authorization.

- Document Preparation: Gather all required documentation including passport copies, photographs, business plan, and any relevant professional certificates or educational qualifications.

- Initial Approval: Submit your application through the Meydan Free Zone portal or through an authorized business setup consultant. The authority reviews your application and issues initial approval if all requirements are met.

- Office Space Selection: Choose your office solution, whether physical office space, flexi-desk arrangement, or virtual office, depending on your business needs and budget.

- License Issuance: Once approvals are complete and fees are paid, the authority issues your Meydan Free Zone Business License Dubai 2026.

- Visa Processing: Apply for investor and employee visas based on your license package and office space allocation.

Required Documents and Eligibility:

To successfully complete setup company in Meydan Free Zone 2026, you’ll need:

- Passport copies of all shareholders and directors (valid for at least six months)

- Recent passport-sized photographs with white background

- Detailed business plan outlining activities, target market, and financial projections

- No Objection Certificate (NOC) from current sponsor if shareholders are UAE residents

- Professional qualifications or educational certificates (for certain regulated activities)

- Proof of address (utility bill or bank statement from home country)

There are no restrictions on nationality, allowing entrepreneurs from anywhere in the world to establish companies. However, certain business activities may require additional approvals from relevant UAE authorities.

Meydan Free Zone Licenses 2026

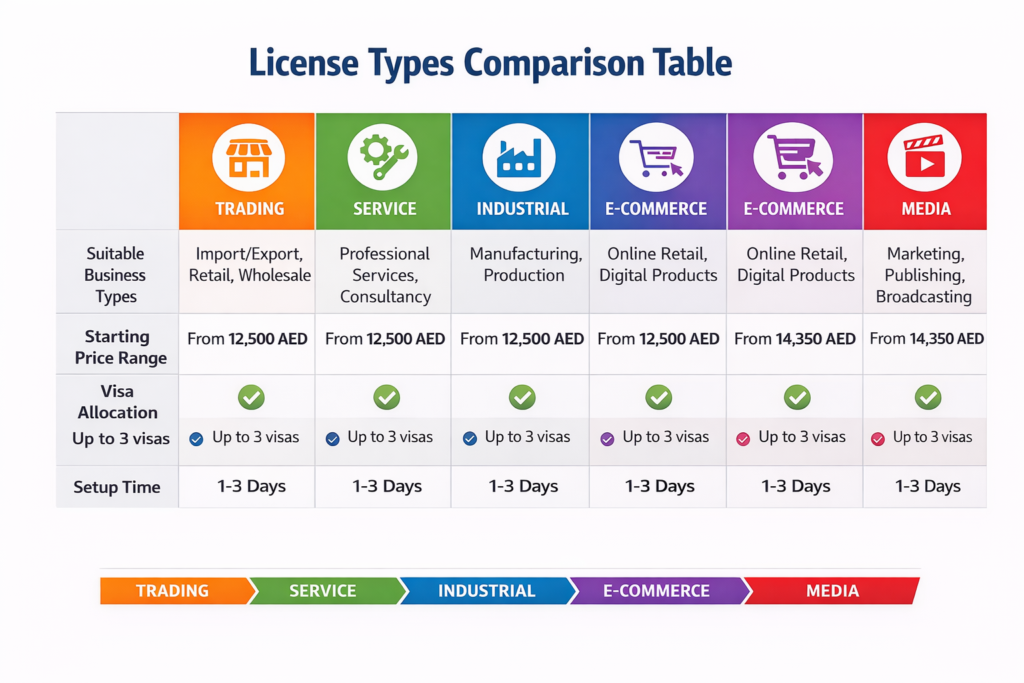

The Meydan Free Zone License Dubai UAE 2026 framework offers several license categories designed to accommodate different business models and operational requirements.

License Types Available:

Trading License: Permits import, export, distribution, and storage of goods. This is ideal for companies engaged in free zone company registration Dubai for commercial trading purposes. Trading licenses can cover general trading or be specific to particular product categories.

Service License: Covers professional services, consulting, management, marketing, IT services, and other service-oriented businesses. Most tech startups and consulting firms operating in Meydan business setup Dubai choose this license type.

Industrial License: For businesses engaged in manufacturing, assembly, processing, or light industrial activities. This license type includes permissions for production facilities within designated areas.

E-commerce License: Specifically designed for online businesses, digital platforms, and companies operating primarily through digital channels. This has become increasingly popular as e-commerce continues to expand in the region.

Educational/Training License: For institutions, training centers, and educational service providers offering courses, certifications, or professional development programs.

Media License: For content creation, production companies, advertising agencies, and media-related businesses.

License Duration and Renewal:

The Meydan Free Zone License Dubai UAE 2026 is typically issued for one year and must be renewed annually. Some license packages offer multi-year options with discounted rates, providing cost savings for businesses committed to long-term operations.

Visa Allocation:

Each license comes with a visa quota based on your office space and license category. Standard packages typically include:

- Small office/virtual office: 2-4 visas

- Medium office: 5-8 visas

- Large office: 9+ visas (with possibility for additional visa blocks)

Additional visas can be purchased separately based on your business needs and available office space.

Fees & Costs Breakdown

Understanding Meydan Free Zone Fees Dubai UAE 2026 is crucial for accurate budgeting and financial planning. The cost structure is transparent and competitive compared to other Dubai free zones.

Initial Setup Costs:

For Meydan UAE company setup fees, expect the following primary expenses:

License Fees: License fees vary based on the type of business activity and the number of activities you wish to include. A standard single-activity license typically ranges from AED 15,000 to AED 25,000 annually. Multiple activities or specialized licenses may cost more.

Registration Fees: One-time establishment fees cover company registration, certificate issuance, and administrative processing, generally ranging from AED 5,000 to AED 10,000.

Office Space: This represents a significant portion of your Meydan license cost Dubai:

- Virtual Office: AED 8,000 – AED 12,000 annually

- Flexi-desk: AED 15,000 – AED 25,000 annually

- Small office (150-250 sq ft): AED 25,000 – AED 45,000 annually

- Medium office (250-500 sq ft): AED 45,000 – AED 80,000 annually

- Large office (500+ sq ft): AED 80,000+ annually

Visa Costs: Each visa includes processing fees, Emirates ID, medical examination, and related expenses:

- Investor/Partner visa: AED 3,000 – AED 5,000 per visa

- Employee visa: AED 3,000 – AED 4,500 per visa

- Dependent visa: AED 2,500 – AED 3,500 per visa

Additional Costs:

Consider these supplementary expenses when calculating your total Meydan Free Zone Fees Dubai UAE 2026:

- PRO (Public Relations Officer) services: AED 3,000 – AED 8,000 annually

- Document attestation and notarization: AED 1,000 – AED 3,000

- Bank account opening assistance: AED 2,000 – AED 5,000

- Business setup consultancy (if using): 10-15% of total setup costs

Annual Renewal Costs:

Expect annual renewal costs to include license renewal fees (similar to initial license cost), office space rental, visa renewals, and any regulatory compliance fees. Most businesses budget approximately 80-90% of their initial setup costs for annual renewals.

Comparison with Other Free Zones:

The Meydan Free Zone Fees Dubai UAE 2026 are competitive when compared to other popular Dubai free zones such as DMCC, DIFC, Dubai South, or Jebel Ali Free Zone. While premium zones like DIFC may have higher costs, Meydan offers an attractive balance of affordability, location, and services, making it particularly appealing for small to medium enterprises and startups.

Regulations & Compliance

Adhering to Meydan Free Zone Regulations Dubai UAE 2026 is essential for maintaining good standing and avoiding penalties or license cancellation.

Key Regulatory Requirements:

Corporate Governance: Companies must maintain proper corporate records including shareholder registers, minutes of meetings, and accurate accounting books. The Meydan free zone rules and regulations require annual general meetings for companies with multiple shareholders.

Financial Reporting: All companies must prepare annual financial statements in accordance with International Financial Reporting Standards (IFRS) or UAE accounting standards. Companies exceeding certain revenue thresholds must have their accounts audited by approved auditing firms registered in the UAE.

Audit Requirements: While small companies may be exempt from mandatory audits, maintaining proper financial records is compulsory. Medium and large enterprises typically require annual audits conducted by licensed auditors.

Employment Compliance: Companies must comply with UAE labor laws regarding employment contracts, working hours, leave entitlements, and termination procedures. Proper employment contracts must be registered with the Ministry of Human Resources and Emiratisation (MOHRE).

Visa Compliance: Maintain valid visas for all employees and ensure renewal processes are initiated well before expiration dates. Working on expired visas or employing individuals without proper work authorization can result in substantial fines.

Activity Restrictions: Companies must operate only within the activities specified on their license. Conducting unauthorized activities can result in penalties, fines, or license suspension.

Reporting Obligations: The Meydan Free Zone Regulations Dubai UAE 2026 require companies to promptly notify the authority of any changes in shareholders, directors, company address, or business activities. Failure to report changes can result in administrative penalties.

Ultimate Beneficial Ownership (UBO): As part of international transparency initiatives, companies must declare their ultimate beneficial owners and maintain updated UBO registers accessible to regulatory authorities.

Tax Compliance: While free zone companies benefit from tax exemptions on corporate income tax under certain conditions, they must still comply with UAE tax regulations including VAT registration if applicable (companies with taxable supplies exceeding AED 375,000 annually).

Visa & Immigration for Meydan Free Zone Companies

The Meydan business visa UAE 2026 process is streamlined and efficient, allowing companies to onboard employees and investors quickly.

Visa Categories Available:

Investor Visa: Issued to company shareholders and partners, typically valid for three years (renewable). This visa allows the holder to sponsor family members including spouse and children.

Employee Visa: Issued to employees hired by the company, typically valid for two years (renewable). The sponsoring company is responsible for all visa-related costs and compliance.

Dependent Visa: Allows visa holders to sponsor immediate family members. Eligibility depends on minimum salary requirements, which vary based on whether you’re sponsoring just a spouse or spouse and children.

Visa Processing Steps:

- Obtain entry permit for new employees or investors

- Complete medical fitness examination at approved centers

- Submit Emirates ID application

- Complete visa stamping process

- Obtain labor card (for employees)

The entire process typically takes 2-3 weeks from entry permit to final visa stamping, making Meydan business visa UAE 2026 among the more efficient processes in the region.

Costs Per Visa Type:

As mentioned earlier, investor visas cost approximately AED 3,000-5,000, employee visas AED 3,000-4,500, and dependent visas AED 2,500-3,500. These costs include medical examinations, Emirates ID fees, typing charges, and government fees.

Visa Quota Management:

Your visa quota depends on your office space size and license type. Companies needing more visas than their standard allocation can request additional visa blocks by upgrading office space or purchasing additional visa packages.

Benefits of Setting Up in Meydan Free Zone 2026

The Meydan Free Zone Dubai UAE 2026 offers numerous advantages that make it an attractive destination for business establishment:

Tax Exemptions: Companies benefit from zero corporate tax (subject to qualifying conditions), zero personal income tax, and no currency restrictions. This creates significant cost advantages compared to many other global business locations.

100% Foreign Ownership: Unlike mainland UAE companies that previously required Emirati partners, free zone companies allow complete foreign ownership without local partnership requirements. This gives international entrepreneurs full control over their business operations and profits.

Capital Repatriation: Businesses can fully repatriate capital and profits without restrictions, providing financial flexibility and peace of mind for international investors.

Customs Duty Benefits: Enjoy exemptions from import and export duties for goods traded within and between free zones, creating cost efficiencies for trading businesses.

Fast-Track Approvals: The Meydan startup support Dubai includes expedited processing for licenses, visas, and approvals, allowing businesses to become operational quickly. Standard setup can be completed in as little as one to two weeks.

Strategic Location: Located in the heart of Dubai with excellent connectivity to major highways, Dubai International Airport, Al Maktoum International Airport, and Jebel Ali Port. This prime location facilitates business operations and client meetings.

Modern Infrastructure: Access to world-class office facilities, meeting rooms, business centers, and amenities within the Meydan complex. The infrastructure supports businesses of all sizes with scalable solutions.

Business Support Services: The authority provides comprehensive support including legal assistance, banking support, visa processing help, and ongoing compliance guidance.

Networking Opportunities: Being part of the Meydan community provides access to networking events, business forums, and connections with other entrepreneurs and established companies.

Flexible Office Solutions: From virtual offices for lean startups to premium office spaces for established enterprises, the range of options accommodates diverse business needs and budgets.

No Minimum Capital: Unlike some jurisdictions that require substantial paid-up capital, Meydan corporate setup UAE has no minimum capital requirements for most business activities, reducing the financial barrier to entry.

How to Get Started in 2026

Ready to begin your Meydan Free Zone Company Formation Dubai UAE 2026 journey? Follow this actionable roadmap:

Step 1: Research and Planning

- Define your business activities and model

- Determine the appropriate license type

- Calculate estimated costs including setup and first-year operations

- Research market opportunities and competition

Step 2: Professional Consultation

- Consider engaging a business setup consultant familiar with free zone company registration Dubai

- Consultants can provide valuable guidance on documentation, processes, and optimization strategies

- Many businesses find the investment in professional services worthwhile for avoiding delays and ensuring compliance

Step 3: Document Preparation

- Gather all required documents as outlined earlier

- Ensure all documents are valid, properly formatted, and meet authority requirements

- Have documents translated to English or Arabic if originally in other languages

Step 4: Application Submission

- Submit your application through the Meydan Free Zone online portal or through your consultant

- Pay applicable fees at each stage

- Respond promptly to any requests for additional information

Step 5: Office Setup

- Select and finalize your office space arrangement

- Complete tenancy agreements or virtual office contracts

- Set up necessary infrastructure including internet, phone systems, and furniture

Step 6: Banking and Administrative Setup

- Open a corporate bank account with a UAE bank

- Register for VAT if your business activities require it

- Set up accounting and bookkeeping systems

Step 7: Visa Processing

- Begin visa applications for shareholders and initial employees

- Complete medical examinations and Emirates ID applications

- Ensure all visa paperwork is properly managed

Step 8: Launch Operations

- Activate your business operations

- Begin marketing and client acquisition

- Implement proper compliance procedures from day one

Contact Information:

To begin your setup company in Meydan Free Zone 2026, contact the Meydan Free Zone Authority through their official website or visit their offices at Meydan Hotel, Dubai. The authority’s customer service team can provide personalized guidance based on your specific business requirements.

Conclusion & Recommendations

The Meydan Free Zone Dubai UAE 2026 represents an exceptional opportunity for entrepreneurs, startups, and established companies seeking to establish or expand operations in one of the world’s most dynamic business environments. With its strategic location, competitive fee structure, comprehensive support services, and business-friendly regulations, the Meydan Free Dubai UAE 2026 continues to attract diverse businesses across multiple sectors.

The combination of 100% foreign ownership, tax advantages, simplified setup processes, and access to the broader UAE and GCC markets makes Meydan business setup Dubai particularly attractive in 2026. Whether you’re launching a tech startup, establishing a trading operation, providing professional services, or entering the e-commerce space, the infrastructure and support systems are in place to facilitate your success.

As global business dynamics continue to evolve and the UAE strengthens its position as a leading international business hub, establishing your presence in the Meydan Free Zone Authority Dubai UAE 2026 positions your company advantageously for regional growth and international expansion. The jurisdiction’s commitment to innovation, efficiency, and business support creates an environment where companies can thrive and scale effectively.

For entrepreneurs and investors planning to launch or expand in 2026, now is the ideal time to explore the opportunities available through Meydan Free Zone Company Formation Dubai UAE 2026. The streamlined processes, transparent fee structures, and comprehensive support services remove many traditional barriers to business establishment, allowing you to focus on what matters most—growing your business and serving your clients.

Take the first step today by researching your specific requirements, calculating your budget, and reaching out to the Meydan Free Zone Authority or qualified business setup consultants. With proper planning and execution, your company can be operational within weeks, positioning you to capitalize on the tremendous opportunities available in Dubai and the broader Middle East market in 2026 and beyond.