Starting a business in Dubai continues to attract entrepreneurs worldwide, and IFZA business setup Dubai UAE 2026 represents one of the most cost-effective pathways for company formation. The International Free Zone Authority (IFZA) offers 100% foreign ownership, flexible licensing options, and streamlined registration processes that make it an attractive choice for startups, SMEs, and international businesses looking to establish their presence in the UAE market.

What Is IFZA Free Zone Dubai?

The IFZA free zone Dubai operates under the International Free Zone Authority, a government-approved economic zone that facilitates business setup for both local and international entrepreneurs. Located strategically within Dubai, IFZA provides a business-friendly ecosystem designed to support various commercial activities.

The IFZA authority UAE was established to create an accessible platform for entrepreneurs who want to benefit from Dubai’s strategic location, world-class infrastructure, and tax advantages without the traditional barriers of mainland company formation. Unlike mainland setups that historically required local sponsors, IFZA allows complete foreign ownership with minimal bureaucratic complexity.

IFZA is particularly suitable for consultants, freelancers, digital entrepreneurs, trading companies, and service providers who want UAE residency, banking access, and the credibility of a Dubai-registered business without significant overhead costs.

Why Choose IFZA for Business Setup in Dubai UAE 2026?

The business setup in IFZA Dubai UAE 2026 offers distinct advantages that continue to attract thousands of entrepreneurs:

Complete Ownership Freedom: Enjoy 100% foreign ownership without requiring a local sponsor or partner. You maintain full control over your business decisions, profits, and operations.

Cost-Effective Structure: IFZA ranks among the most affordable free zones in Dubai, with competitive licensing fees and flexible office solutions including flexi-desk options that eliminate expensive physical office requirements.

Multiple Business Activities: A single license can accommodate multiple business activities, providing flexibility as your business evolves and diversifies without requiring additional licenses for each activity.

Simplified Visa Processing: The IFZA free zone benefits include straightforward visa applications for investors, partners, and employees, with processing times typically faster than many other jurisdictions.

No Currency Restrictions: Operate with complete currency freedom, repatriate 100% of capital and profits, and conduct business in any currency without exchange controls or conversion requirements.

Access to UAE Banking: IFZA companies can open corporate bank accounts with major UAE and international banks, providing credibility and facilitating seamless financial operations.

Strategic Location: Benefit from Dubai’s position as a global business hub connecting Asia, Europe, Africa, and the Middle East, with excellent logistics infrastructure and connectivity.

IFZA Company Formation Process (Step-by-Step)

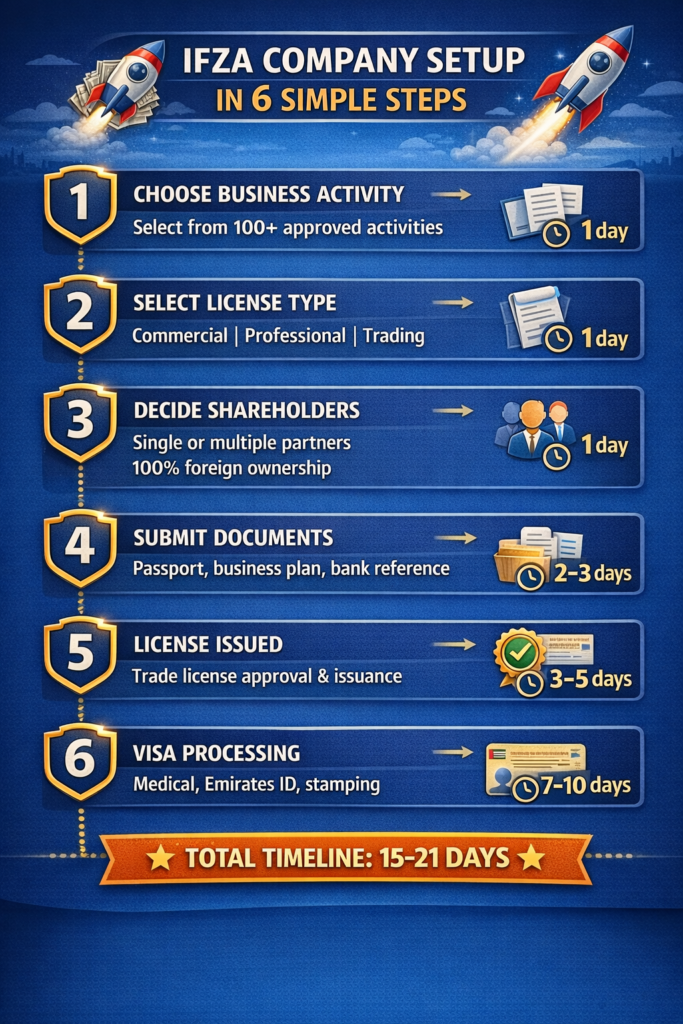

The IFZA company registration process has been streamlined for efficiency. Here’s how company setup in IFZA Dubai UAE 2026 works:

Step 1: Select Your Business Activity – Identify your primary business activities from IFZA’s extensive approved list. You can include multiple activities under one license, ensuring your company can operate across different service or trading areas.

Step 2: Choose Your License Type – Determine whether you need a commercial, professional, or trading license based on your business model and intended operations.

Step 3: Decide Shareholder Structure – Define your ownership structure, including the number of shareholders and their respective ownership percentages. IFZA accommodates single-shareholder companies as well as multiple-partner structures.

Step 4: Submit Required Documentation – Prepare and submit necessary documents including passport copies, business plan, proof of address, and bank reference letters. The documentation requirements are straightforward and clearly defined.

Step 5: License Issuance – Upon approval and payment of fees, IFZA issues your trade license typically within a few business days, allowing you to commence operations immediately.

Step 6: Visa Application and Processing – Apply for investor and employee visas based on your license quota. The visa process includes medical fitness tests, Emirates ID registration, and final stamping.

IFZA License Types in 2026

Understanding IFZA license types (commercial, professional, trading) helps you select the appropriate authorization for your business:

Commercial License: Designed for trading activities, import-export operations, and businesses dealing with physical goods. This license type is ideal for e-commerce stores, distributors, wholesalers, and retail operations conducted within free zone regulations.

Professional License: Suited for service-based businesses and consultancies. Professionals including consultants, marketing agencies, IT service providers, designers, and advisors typically operate under this category. The professional license covers knowledge-based services without physical product trading.

Trading License: Specifically structured for companies engaged in buying, selling, and distribution of goods. Trading license holders can conduct international trade operations, manage supply chains, and operate as intermediaries in commercial transactions.

Each business license in IFZA Dubai UAE 2026 allows multiple activities within the same category, providing operational flexibility as your business portfolio expands.

IFZA License Cost & Setup Fees in Dubai UAE 2026

The IFZA cost Dubai UAE 2026 remains competitive compared to other Dubai free zones. While exact fees vary based on specific requirements, here’s what influences your total investment:

Base License Fee: The starting package for IFZA company setup fees typically begins around AED 10,000 to AED 15,000 annually, depending on the license type and included services. This base cost covers your trade license and basic registration.

Factors Affecting Total Cost:

- Number of business activities (multiple activities may increase fees)

- Visa allocation quota (each additional visa slot adds to the cost)

- Number of shareholders and their respective visa requirements

- Office space requirements (flexi-desk, dedicated desk, or private office)

- Additional services like PRO assistance, document attestation, or expedited processing

Additional Charges to Consider:

- Government registration fees

- Bank account opening assistance

- Legal documentation and notarization

- Initial visa processing and medical tests

- Emirates ID fees for each visa holder

The transparent fee structure means the setup IFZA company Dubai UAE 2026 process involves predictable costs without hidden charges. Most packages are all-inclusive, covering license, visa allocation, and essential services in a single annual fee.

IFZA Visa Cost & Requirements

Understanding IFZA visa cost Dubai is crucial for budgeting your complete setup:

Investor Visa: The primary business owner receives an investor visa valid for 2-3 years depending on the package selected. Investor visa costs typically range from AED 3,000 to AED 5,000 including medical tests, Emirates ID, visa stamping, and related fees.

Employment Visas: Employee and dependent visas cost approximately AED 3,000 to AED 4,500 per person, covering the complete process from application to final stamping.

Visa Requirements:

- Valid passport with minimum six months validity

- Passport-sized photographs with white background

- Medical fitness certificate from approved health centers

- Emirates ID registration

- Entry permit and visa stamping fees

The IFZA office requirement for visa issuance is satisfied through their flexible workspace solutions, meaning you don’t need to lease expensive physical offices to qualify for visa allocation.

IFZA Corporate Tax & Compliance in UAE 2026

The UAE introduced corporate tax effective from June 2023, and understanding IFZA corporate tax UAE obligations is essential:

Corporate Tax Rate: Businesses generating taxable income above AED 375,000 are subject to 9% corporate tax on profits. Companies below this threshold pay zero corporate tax.

Free Zone Qualifying Income: Companies that meet specific conditions may benefit from 0% tax on qualifying income. These conditions include not conducting business with UAE mainland, maintaining adequate substance, and complying with transfer pricing regulations.

Compliance Requirements: All IFZA companies must maintain proper accounting records, file annual returns, and comply with UAE tax authority regulations regardless of revenue levels.

VAT Registration: If your annual revenue exceeds AED 375,000, VAT registration becomes mandatory. Businesses can voluntarily register for VAT at lower thresholds to reclaim input tax.

Working with qualified tax advisors ensures your IFZA business remains compliant while optimizing legitimate tax benefits available under free zone regulations.

IFZA Free Zone vs Mainland Company Setup

Comparing IFZA mainland vs free zone options helps clarify which structure suits your business:

| Feature | IFZA Free Zone | Dubai Mainland |

|---|---|---|

| Ownership | 100% foreign ownership | 100% foreign ownership (post-2021 reforms) |

| Local Sponsor | Not required | Not required (for most activities) |

| Office Space | Flexible (flexi-desk available) | Physical office often required |

| Setup Cost | Lower (starting ~AED 10,000) | Higher (typically AED 15,000+) |

| Mainland Trading | Requires distributor | Direct mainland access |

| Visa Processing | Streamlined | More complex |

| Annual Costs | Generally lower | Generally higher |

| Business Activities | Wide range permitted | All activities permitted |

IFZA provides cost advantages and simplified processes, while mainland offers unrestricted market access within the UAE. Your choice depends on whether you need direct mainland trading access or can operate through distributors while enjoying lower costs.

IFZA License Renewal Cost & Annual Maintenance

Planning for IFZA renewal cost ensures business continuity:

Annual License Renewal: Trade license renewal occurs annually and typically costs similar to initial setup fees, ranging from AED 10,000 to AED 15,000 depending on your package and any changes to business activities or visa quotas.

Visa Renewal Timeline: Visas must be renewed before expiration. Employment visas typically require renewal every 2-3 years, involving medical tests, Emirates ID renewal, and stamping fees of approximately AED 3,000 to AED 4,000 per person.

Compliance Renewals: Additional annual compliance requirements may include office lease renewals, business activity confirmations, and regulatory filings with IFZA authorities.

Early Renewal Benefits: Renewing your license 30-60 days before expiration often provides grace periods and avoids late penalties that can significantly increase costs.

Budgeting for these recurring expenses ensures uninterrupted operations and maintains your company’s good standing with UAE authorities.

IFZA Business Activities List (Overview)

The IFZA business activities list encompasses diverse sectors:

Information Technology & Digital Services: Software development, IT consulting, web development, app creation, digital marketing, cybersecurity services, cloud solutions, and technology consulting.

Trading Activities: Import-export operations, general trading, e-commerce, wholesale distribution, commodity trading, electronics trading, and product sourcing.

Consultancy Services: Management consulting, business advisory, financial consulting, HR consulting, legal consulting, marketing strategy, and professional advisory services.

E-commerce & Online Business: Online retail, digital marketplaces, dropshipping operations, affiliate marketing platforms, and internet-based service delivery.

Media & Marketing: Content creation, advertising services, public relations, social media management, graphic design, branding services, and digital content production.

Professional Services: Accounting, auditing, legal services (within free zone regulations), engineering consultancy, architectural services, and specialized professional advice.

Most business owners can operate multiple complementary activities under a single license, providing operational flexibility and growth potential without requiring separate company formations.

Common Mistakes to Avoid in IFZA Business Setup

Learning from others’ experiences helps ensure smooth setup IFZA company Dubai UAE 2026 process:

Choosing Incorrect Business Activities: Selecting activities that don’t accurately reflect your operations can create compliance issues or require costly license amendments. Be comprehensive when listing activities during initial registration.

Underestimating Visa Costs: Many entrepreneurs budget for license fees but forget to account for complete visa processing costs including medical tests, Emirates ID, and dependent visas, leading to unexpected expenses.

Ignoring Renewal Planning: Failing to plan for annual renewal deadlines can result in late penalties, business interruption, and potential visa cancellations affecting your entire team.

Inadequate Banking Documentation: Not preparing proper business documentation can delay or complicate corporate bank account opening, affecting your ability to operate effectively.

Overlooking Tax Obligations: Assuming free zone status means zero tax compliance is incorrect. Understanding and fulfilling corporate tax and VAT obligations prevents penalties and legal complications.

Choosing Inappropriate Office Solutions: Selecting office packages that don’t match your actual needs results in either overpaying for unused space or facing limitations that hinder operations.

Is IFZA Right for Your Business in 2026?

The setup IFZA company Dubai UAE 2026 option suits specific business profiles:

Ideal for Startups: If you’re launching a new venture with limited capital, IFZA’s affordable setup costs and flexible structures provide an accessible entry point into the Dubai market without excessive financial commitment.

Perfect for SMEs: Small and medium enterprises benefit from IFZA’s scalable solutions that grow with your business, allowing you to start small and expand visa quotas, office space, and services as revenues increase.

Excellent for International Entrepreneurs: Foreign business owners seeking UAE residency, banking access, and a respected Dubai business address find IFZA particularly valuable, especially for service-based and online businesses.

Suitable for Remote Businesses: Digital nomads, online consultants, e-commerce operators, and location-independent professionals can maintain a UAE corporate presence while operating globally.

Best for Service Providers: Consultants, freelancers, agencies, and professional service providers who don’t require mainland market access or physical retail presence maximize IFZA’s benefits.

However, businesses requiring direct mainland retail operations, significant physical warehousing, or unrestricted UAE market access might find mainland licensing more appropriate despite higher costs.

Conclusion

The IFZA business setup Dubai UAE 2026 continues offering entrepreneurs a strategic, cost-effective pathway to establishing legitimate Dubai-based companies with full foreign ownership and operational flexibility. From competitive IFZA license Dubai UAE 2026 fees to streamlined visa processing and diverse business activity options, IFZA represents an accessible gateway to the UAE’s dynamic business ecosystem.

Whether you’re a consultant, trader, digital entrepreneur, or service provider, understanding the complete picture of IFZA cost Dubai UAE 2026, compliance requirements, and strategic advantages ensures informed decision-making aligned with your business objectives.

If you’re planning IFZA business setup in Dubai UAE 2026, expert guidance can save cost, time, and compliance risks. Professional company formation specialists navigate the registration process efficiently, ensure proper documentation, optimize your license structure, and establish your Dubai business with confidence and compliance from day one.